ESDS Unlisted Share Company Details

ISIN NUMBER

INE0DRI01029

FACE VALUE

₹ 1

Current Ratio

1.09

EPS

₹ 2.07

P/E Ratio

N/A

NET REVENUE

₹ 198 Cr.

NET PROFIT

₹ -2.66 Cr.

ROE

-1.36%

Cashflow from Operations

₹ 16.44 Cr.

About ESDS Unlisted Share

- ESDS is India’s leading managed cloud service and end to end multi-cloud requirements provider (Source: Ken Research Report).

- The company has built a comprehensive cloud platform which the customers rely on, consisting of cloud infrastructure, well-architected solutions aimed at reducing cost and providing safety, flexibility, scalability and reliability to enterprises compared with the traditional on-premise IT models.

As part of the portfolio, the company offers:

(a) Cloud Computing Infrastructure as a Service (IaaS) which includes our patented vertically auto scalable cloud technology platform, “eNlight Cloud”;

(b) Software as a Service (SaaS) and Managed Services, which include, (i) SaaS which is a software distribution model wherein we host applications on cloud platforms and make them available to end users on periodic subscription model, allowing clients to develop, run and manage applications, and (ii) Managed Services, through which we offer several services enabling companies to optimise and modernise their cloud environment, secure their data and migrate their legacy data on cloud environments, and fully manage it on a day to day basis.

ESDS operates its business on an asset light model, which comprises of ownership of computing hardware assets only, thereby allowing quicker scalability and reduced capital cost of operations.

The company offers products across diversified industries that include government ministries & companies and corporate entities across sectors such as BFSI, manufacturing, IT and ITES, telecom, real estate, pharmaceuticals, retail and education and in several countries across the APAC region, Europe, Middle East, the Americas and Africa.

Further, the company provides both in house and third party developed applications on a digital marketplace developed by us, namely “Spochub”. Spochub enables the comapny and its software vendors to offer their solutions with custom packages to enterprise customers.

The company operates its business through three data centres in India, one each in Navi Mumbai, Nashik, and Bengaluru. The data centres cover, in aggregate, 50,000 square feet across the three locations in India. The data centres are connected on a 10 Gbps backbone network (a backbone network is a part of a computer network that interconnects data centre locations), providing a secure path for the exchange of information between different local area networks (LANs) or subnetworks, and are backed up with state-of-the-art disaster recovery services.

The customers include Larsen & Toubro Limited, Tech Mahindra Limited, EDF India Private Limited, Software Technology Parks of India, EPL Limited, Symphony Limited, and US Technology International Private Limited, with many of whom the company has been able to establish long-term relationships.

Market Statistics

The IT/ITES sector is the largest employer within India’s private sector. In the Indian Budget of 2021, the Government of India allocated USD 7.3 billion to the IT and telecom sectors and has also provided tax holidays to the IT sector for Software Technology Parks of India and Special Economic Zones.

The push towards cloud services has boosted hyper-scale data center investments, with global investments estimated to exceed ~US$ 200 billion annually by 2025. India is expected to gain a significant share in the global market, with the country’s investment expected to hit ~US$ 5 billion annually by 2025. Backed on key technologies of artificial intelligence, machine learning, big data and analytics, IoT, the IT/ITes sector in India is expected to benefit immensely from the increased adoption across end-user firms of all types and sizes.

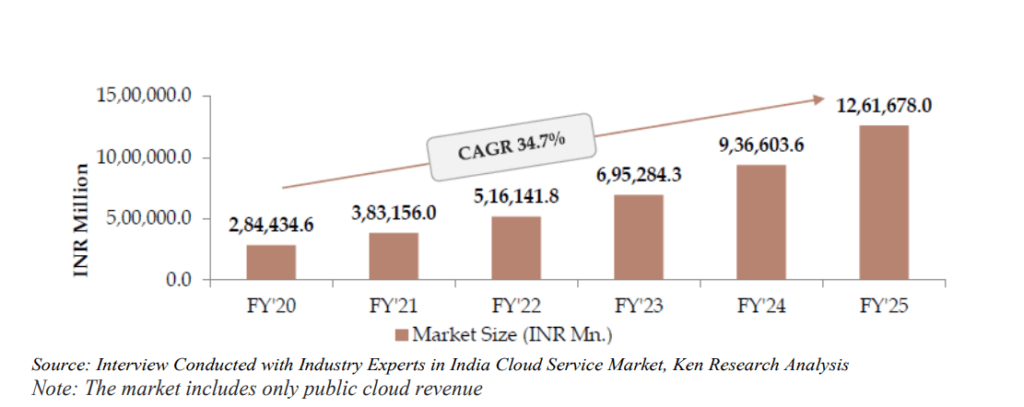

The Indian cloud services market has grown at a CAGR of 27.8% from 2015 to 2020 and is expected to grow at a CAGR of 34.7%, from INR 284.4 billion in 2020 to INR 1,261.7 billion in 2025.

ESDS Unlisted Share IPO Details

- The company has filed its DRHP with SEBI and might be coming out with its IPO soon.

- ESDS share price is trading in the range of Rs. 265-290 in the unlisted market

ESDS Share Price

ESDS share price is decided on the basis of it’s funding round that it raised from it’s investors. After that, price is decided by the forces of demand and supply as same as listed market. ESDS share price is Rs 265 per share with a face value of Rs 1.

ESDS Peers

Following are the close Listed Peers of the company:

ESDS Valuation and Analysis

ESDS Unlisted Share Subsidiaries

- ESDS Internet Services Private Limited Subsidiary Company

- ESDS Global Software Solution Inc., a wholly owned subsidiary company

- ESDS Cloud FZ LLC is a wholly owned subsidiary company.

- Spochub Solutions Private Limited is a wholly owned subsidiary company.

Board Members-ESDS Unlisted Share

Consolidated Results ESDS Unlisted Share

Profit and Loss Statement

*figures in Cr Except EPS

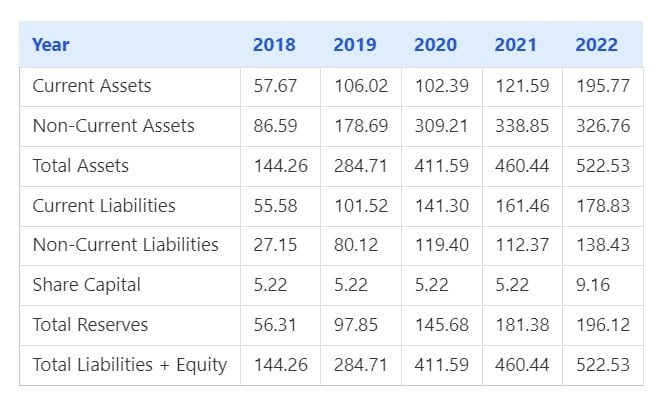

Balance Sheet

*figures in Cr

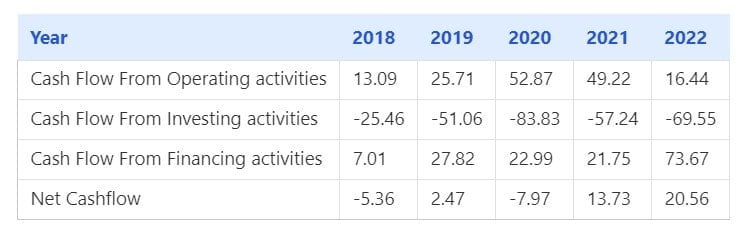

Cashflow

*figures in Cr

- Strengths

- Comprehensive and integrated range of offerings that provide a “one stop shop” for managed cloud solutions to a diversified and marquee clientele.

- Leadership position in the industry with a proven track record

- Strength and experience of our senior management team

- Innovative billing solutions that derive value to customers.

News-ESDS Unlisted Share

Taparia Tools is a well-recognized name among manufacturers in the hand tools manufacturing industry and has been in the news lately for its gaining spree in the stock market. With a well-established history of over five decades, the company is considerably placed in India and various overseas markets. In this article, we will discuss the Taparia Tools company’s background, stock price history, and whether this is the right time for investment in Taparia Tools Share. Company Overview Taparia Tools Limited was established in 1965 and has since grown to be one of the largest Hand Tool manufacturers in India. The company produces a wide range of tools, including spanners, pliers, screwdrivers, hammers, and toolsets that cater to domestic and international markets. Its products are applied in many industries such as building, general DIY, and automotive repairs. It is headquartered in Mumbai, with its manufacturing plants located in Nashik, Maharashtra. Taparia Tools markets its products under the brand name “Taparia” and exports to countries like the United States, the United Kingdom, Germany, and many others in Europe, Asia, and South America. Its brand is highly regarded for being durable, accurate, and quality-based. Taparia Tools Share Price History One such stock that has recorded remarkable growth compared to other competitors in the Indian market is Taparia Tools. Further, this stock moved between ₹2.79 and ₹7.96 within a year, proving that it may be a little turbulent at times. Long-term investors in Taparia Tools have seen the company grow steadily, and the company has been regularly rewarding its shareholders through the issue of dividends. For instance, the company has reported an increase in earnings for these years consistently and declared an EPS of ₹ 65.73 in FY 2024 against ₹ 47.65 in FY 2023. It is these earnings that have boosted investor confidence, and Taparia Tools has emerged as one of those companies where investors can get assured returns in the long term. However, potential investors need to be aware that share prices could vary depending on the market conditions and the trends of the industry. These factors will need to be monitored continuously before any decisions are made to invest in shares. Taparia Tools Current Share Price The Taparia Tools Share Price, as of September 2024, is ₹7.96. The market capitalization of the company stands at ₹12 crore, hence making the stock fall under small-cap in the Indian stock market. That would also mean the company has tremendous scope for growth but at the same time may be more risky compared to other bigger companies. An important investment advantage of Taparia Tools is the fact that it is a debt-free company. The company has no outstanding debt and holds substantial cash reserves of ₹155 crore. This financial stability is a crucial measure of the company’s ability to withstand market volatility. Financial Performance and Investment Considerations The most important factor for any investment in Taparia Tools is its financial performance. It grows continuously with respect to revenue and profitability, thus making it a good long-term investment opportunity. With an aggregate revenue of ₹848 crore and a net profit of ₹387 crore over a period of ten years, Taparia Tools has established its capacity for stable earnings. Ownership Structure: Taparia Tools has promoter ownership at 69.72%, which tends to be a good sign that people running the business are fully committed and aligned with the interests of the shareholders. High levels of promoter holdings are generally perceived positively by investors because it indicates that the management is fully invested in the long-term perspective of the company. However, the liquidity of Taparia Tools stands on the lower side, and enough shares may not be available in the open market. This may lead to cases of price fluctuation, thereby making it trying for investors to get in or out at good prices. Factors That Have Caused Volatility and Growth in Share Price There are some factors that have combined to cause volatility and growth potential in the share price of Taparia Tools: 1. Demand for hand tools in the global platform: Not only do growth improvements continue to develop in developing markets, but growth also gains momentum in emerging sectors of building and construction and auto-repairing. This marks a good opportunity for Taparia Tools to expand the business. As the normalization of a pandemic-stricken global economy progresses, this company is well-positioned to see higher orders for its product offers. 2. Export Markets: Taparia Tools exports to many countries, including the high-demand markets of the US, UK, and Germany. Improvement in such export markets or new export markets may form a leapfrog step for the company’s turnover. 3. Financial Health: The fact that the company is debt-free and enjoys strong cash reserves puts it in a very enviable position to make future investments in technology, manufacturing capacity, or even marketing. Which easily can mean higher revenues and profits in the future. 4. Risks and Volatility: Such volatility of the stock, especially for short-term investors, is a cause of concern. As most of the small-cap stocks are frequently trending up or trending down in price, Taparia, too, can depict similar price aberrations. Investors with higher risk intolerance may think twice about this investment. Other Factors: 1. Dividend: Taparia Tools has been paying regular dividends to the shareholders during the last few years. This might be the largest positive for investors, who are seeking stable returns. However, income through dividends is never assured, and any prospective investor should be satisfied with all other risks before investing to get income through dividends. 2. Market Competition: Taparia Tools operates in a competitive market. Despite the company’s strong brand, there are more competitors in the global hand tool industry. To remain competitive in the market, the company will need to innovate and expand. 3. Long-term Investment: Apart from the strong financial position, Taparia Tools would be a good option for the long-term investor concerning the growth prospects. However, it would be more of the keyword regarding patience since the stock is

Based on GMV, PharmEasy is the biggest digital healthcare platform in India. It is the greatest platform for online consultations, diagnostic testing, and medication. With 25 million registered customers, 87,194 pharmacies, 3,261 wholesalers, 4,617 clinics, prescribing physicians, and 926 hospitals, PharmEasy is a well-known brand. The company works on advanced AI/ML to manage the workflow and improve its transactions. The unlisted share price of API Holding Ltd. (PharEasy) has experienced a significant decrease in the last few years. The share price dropped from Rs 135 to Rs 22. Despite the unclear circumstances surrounding the company’s rise, investors continue to place bets on the company and receive substantial returns. According to the RedSeer Report, the company, which was founded on March 31, 2019, is the biggest digital healthcare platform in India (based on the GMV of goods and services sold for the year that concluded on March 31, 2021). API Holdings runs a complete, integrated business with the goal of meeting consumer healthcare needs at the following important stages: supplying digital resources and health and wellness information, providing teleconsultation, providing radiological testing and diagnostics, administering treatment plans, and supplying goods and equipment. The PharmEasy marketplace is powered by the company’s unique technological platform, which also owns the “PharmEasy” trademark. The business has granted Aarman, which owns a 19.99% equity stake, a license to use the brand and the technology. The PharmEasy marketplace is managed by Axelia. PharmEasy Share Price Face Value ₹ 1 per share Current Ratio 3.67 Code ISIN INE0DJ201029 PharmEasy Unlisted Share Price ₹ 11/Share Net Profit ₹ -641 Cr Net Revenue ₹ 2360 Cr. ROE -33.51% Lot Size 500 shares Demat Status CDSL, NSDL Market Cap INR 15,972 Cr. Pharmeasy Share IPO Details Although the company had previously filed a DRHP, its preparations for an IPO were withdrawn. As of right now, there are no updates available on Pharmeasy’s IPO. In the unlisted market, Pharmeasy’s share price is now trading between Rs. 18 and Rs. 20. Business Segment of Pharmeasy Company In order to win the trust of different clients, the Pharmeasy online marketplace offers an online platform for security and updates customers easily about their services on a regular basis. This platform operates in a particular manner to guarantee that the drugs and services it offers are of the very best quality and are supplied on schedule. In the first phase of the PharmEasy business plan, the client provides the company with their prescription information. Before this prescription is delivered to a neighboring pharmacy for the customer’s use, it is examined using a certain set of criteria. PharmEasy has a variety of partnerships and authorized pharmacies with which it works to assess prescriptions, essential medications, and other benefits associated with the medication. After that, by the guidelines, a transport company will get the prescription and the drugs so that the pharmacy can confirm and check them. In certain cases, the chemist can also contact you if they have any issues with the prescription. The purchase is dispatched for delivery when it has been validated and examined. Strengths of Pharmaeasy Company The modern world has seen a rise in internet usage due to technological advancements, and many individuals now find it quite easy and simple to make purchases online. It helps firms like PharmEasy, which has been online from the day it was founded, particularly in considering the pandemic and the large number of other companies that have made the switch to the Internet. Valuation and Analysis of PharmEasy PharmEasy was founded in 2014 and obtained angel money in 2015. Following that, the creators took part in further funding rounds. The company’s goals after receiving money from the Series A round were to develop a home diagnostic service and grow its operations to five locations. After the fundraising round, PharmEasy launched its online platform for healthcare products and services, which covered over 700 cities. Clients have well received the platform. PharmEasy combined with Ascent Health and more firms in 2020 and 2021, forming API Holding Limited, the parent company. After that, it purchased a 66% stake in Thyrocare and became the first unlisted business to buy shares of a listed company. The pre-IPO market performance of PharmEasy is mostly influenced by its financial growth and decrease. In the last two years, the company’s expenses have also soared, rising from Rs 270 crore to Rs 1549 crore. In light of PharmEasy’s IPO announcement, investors should consider current performance while making selections. Experts predict that PharmEasy will grow at a pace of between 30 and 40 percent following the IPO. Before PharmEasy is listed on a stock exchange, you can purchase company shares that are unlisted. Why Should You Purchase Pharmeasy Unlisted Shares? Purchasing unlisted company shares is a fantastic method to lower risk and diversify an investment portfolio. PharmEasy intends to become public this year, so if you invest in its unlisted shares early, you can benefit from long-term profits. The low availability and significant growth potential of PharmEasy’s unlisted shares are further incentives to invest. But, while making an investment in PharmEasy, you should take both past and current performance into account equally. Looking for advice from specialists is the best course of action. You may get the best guidance on unlisted shares by getting in touch with our staff. Retail investors can purchase a variety of blue-chip companies on Stockify, a reliable marketplace for purchasing unlisted shares. Here you Conclusion Making informed decisions in 2024 requires investors to have a thorough understanding of the PharmEasy unlisted share price data. To get the most out of your investing plan, pay attention to market fluctuations and think about taking a diversified approach.

Boat (Imagine Market Ltd.) sells a variety of products, including wearables like smart watches, mobile accessories like cables and trimmers, wireless speakers, wired headphones, wired earphones, and wireless headphones. In addition to selling its goods offline, the company also offers them online through markets and its own website. 83.24% of the company’s items were sold through online marketplaces as of H1 2022, 13.84% through its own website, and 2.93% through traditional channels. The business is now concentrating on offline channels as well. By September 30, 2021, items were offered for sale in more than 23,000 retail locations throughout India. This was made possible by a retail network that included more than 180 sub-distributors and over 51 distributors operating in more than 32 states and union territories. The company competes with a number of domestic and foreign businesses in the industry in which it works. Our rivals include foreign and heritage audio companies, up-and-coming Indian brands, Chinese smartphone OEMs, and online marketplace private labels. The primary rivals of the business include Samsung, Realme, Oneplus, Noisy, Nothing, and others. Industry Description BoAt Share Price The boat has had significant financial growth in the last few years. In recent years, the company has experienced profitable growth. Boat recorded revenue of Rs 4000 crore for FY23, a 40% increase from the previous year. Boat recorded revenue of Rs 2886 Cr and profit of Rs 78 Cr for FY22. ISIN NUMBER INE03AV01027 FACE VALUE ₹ 1 Current Ratio 1.23 EPS ₹ 5.09 P/E Ratio 167.97 NET REVENUE ₹ 2886 Cr. NET PROFIT ₹ 78.82 Cr. ROE 14.79% BoAt Unlisted Share IPO Details The company had intended to raise about Rs 2000 crore through an IPO (initial public offering) and submitted its Draft Red Herring Prospectus (DRHP) with the SEBI on January 26, 2022. However, the business has now postponed its initial public offering (IPO) plan, and Boat has opted to use a private placement to acquire 500 million dollars from two sources: a new investor, Malabar Investments, and an affiliate of the international private equity firm Warburg Pincus. The money will be raised through preference shares. Valuation and Analysis Of Boat As Boat dropped its IPO plans, it raised these funds. The company raised this money at a price of Rs 750 per share at a time when its revenue was INR 2800 crore. As of FY23, boat revenue has increased to almost INR 4000 crore. In order to satisfy demand, Boat plans to use these funds to expand its production plant. The price of boat shares on the unlisted market has also grown as a result. The business is expanding profitably and at a very rapid pace. How To Buy BoAt Unlisted Share Price With BharatInvest? The process for purchasing BoAt unlisted Shares/Pre-IPO shares at Bharat Invest is shown below: Strengths Of Boat Unlisted Shares How to sell BoAt Unlisted Shares/Pre-IPO shares with BharatInvest? The process for selling BoAt Unlisted Shares/Pre-IPO shares at Bharat Invest can be found below. Conclusion Investors need to understand the Boat share price data thoroughly in order to make wise decisions in 2024. Consider adopting a diversified strategy and be aware of market trends if you want to increase the returns on your investment plan.

FAQs- ESDS Unlisted Share

Please find below the procedure for buying ESDS Unlisted Shares/Pre-IPO shares at Bharat Invest.

- You confirm booking of ESDS Unlisted Shares/Pre-IPO shares with us at a specified price.

- You have to provide your client master report along with PAN Card and Cancelled Cheque in case you are not transferring funds from the bank account as mentioned in the CMR Copy. These are KYC documents required as per SEBI regulations.

- We will provide our bank details.

- You need to transfer funds in the current account of bharatinvest.

- No cash deposit is accepted

- Payment has to be done from the same account in which shares are to be credited.

- We ensure delivery of ESDS unlisted shares within 24 hours.

- Incase of non-availability of shares, we refund the amount to the same bank account within 24 hours.

- For detailed discussion, you can contact us via any medium.

Please find below the procedure for selling ESDS Unlisted Shares/Pre-IPO shares at Bharat Invest.

- We will confirm our buying price of ESDS Unlisted Shares/Pre-IPO shares.

- We will give you our client master report and you will transfer the ESDS Unlisted Shares/Pre-IPO shares to our demat account.

- We will transfer the funds in your bank account within 24 hours of receiving the ESDS Unlisted Shares/Pre-IPO shares .

- All the transactions will be bank to bank.

- Payment will be given in the same account which is linked to demat account or you need to provide the cancelled cheque shows your name to verify.

- You can contact us through any medium for a detailed discussion.

- The lockin period is of 6 months for pre-ipo investors i.e. they cannot sell their shares for 6 months after they get listed. However, they can definitely sell the shares in pre-ipo market before they get listed.

- With BharatInvest , you can now invest in unlisted/pre-ipo shares with as low as 25-50k depending upon the share.

- You can download the NSDL or CDSL application and login into the account and check whether the shares have been credited or not.

- Credit of Unlisted Shares/Pre-IPO shares Unlisted Shares can be checked in brokers application as well but it takes T+2 days to show the shares.

- The value of share in unlisted space is determined in the same way as it is done in listed market. Demand and supply decide the price of any share. If the demand more than the supply, then the prices of the share increases and vice versa.

- When a new shares is introduces in the unlisted space, the value of the company is decided upon the last funding raised by company. If the company hasn’t raised any funding in the past, then the valuation is decided upon the fundamentals of the company.

- All the transactions are done DEMAT to DEMAT. All the unlisted shares traded with us are available in demat accounts and are transferred to your demat within 24 hours of payment.

Bharatinvest is India’s leading investment bank. Here you can invest unlisted, pre-ipo or delisted shares of ESDS Software at best price. At Bharatinvest, you will get all the updates regarding ESDS Software unlisted share price, IPO news, IPO price, GMP, ESDS Software share news, events, dividends, company related news, ISIN, lot size, Financials ( ESDS Software Profit and loss statement, ESDS Software Balance Sheet, ESDS Software cash flow statement ), Peer comparision and analyst views. Investing in ESDS Software share before ipo can help you invest in shares when they are available at low prices. Holding them on long term basis will help you create wealth in long term and enjoy compounding benefits. Our investors have made an average 250% returns by investing in pre-ipo shares. Buy ESDS Software unlisted or Pre-ipo share at best price from our tech-platform today. You can connect with our expert financial advisors for any guidance.