Frick India Unlisted Shares Company Details

ISIN NUMBER

INE499C01012

FACE VALUE

₹ 10

Current Ratio

2.59%

EPS

₹ 272.73

P/E Ratio

13.01

NET REVENUE

₹ 287 Cr.

NET PROFIT

₹ 16.67 Cr.

ROE

8.37%

Cashflow from Operations

₹ 3.23 Cr.

About Frick India Unlisted Shares

- Frick India has 60 years of experience in industrial refrigeration compressor manufacturing to provide reliable refrigeration systems in India and 50 other countries across the world. It is among the top 10 companies in India due to its good quality, and its equipment is rated among the world’s best.

- Frick India Limited, through its products and manufacturing facilities, has been serving the following industries:

- Dairies and Ice Cream Industries

- Food and Agriculture Industries

- Beverages and Brewery Industries

- Refrigeration Systems for Chemical and Pharmaceutical Industries

- Refrigeration System for Meat, Poultry, and Sea Food Industry

- Air-Conditioning

- Low-temperature application

- The main products are:

Rotary Twin Screw Compressor Blocks, Rotary Twin Screw Compressor Packages, High Speed Reciprocating Compressors, Liquid Overfeed System, Evaporative Condensers, Two Stage Compound Reciprocating Compressor, Frigid Coils “S” Series (Stainless Steel Tubes & Aluminum Fins), and Frigid Coils “A” Series (Aluminum Tubes & Aluminum Fins)

- Frick India Limited was named the “Most Trusted Industrial Refrigeration Equipment Manufacturing Company of the Year” at the Business Leaders Summit Awards 2019, which took place in Mumbai.

- In 1962, FRICK INDIA LIMITED was formed as a public limited company in collaboration with Frick Company USA.

Market Statistics

- The long-term outlook for the global refrigeration and air conditioning compressors market size is projected to reach USD 19750 million by 2028, from USD 16630 million in 2021, at a CAGR of 2.5% during 2021–2028. The introduction of sustainable compressors for commercial refrigeration applications is a key trend identified in the global refrigeration and air conditioning compressors market across the globe.

Frick India Unlisted Shares IPO Details

There is currently no information available about the IPO.

Frick India share price is trading in the range of Rs. 5500-6500 in the unlisted market

Frick India Share Price

Frick India share price is decided on the basis of it’s funding round that it raised from it’s investors. After that, price is decided by the forces of demand and supply as same as listed market. Frick India share price is Rs 5500 per share with a face value of Rs 10.

Frick India Peers

Following are the close Listed Peers of the company:

Frick India Valuation and Analysis

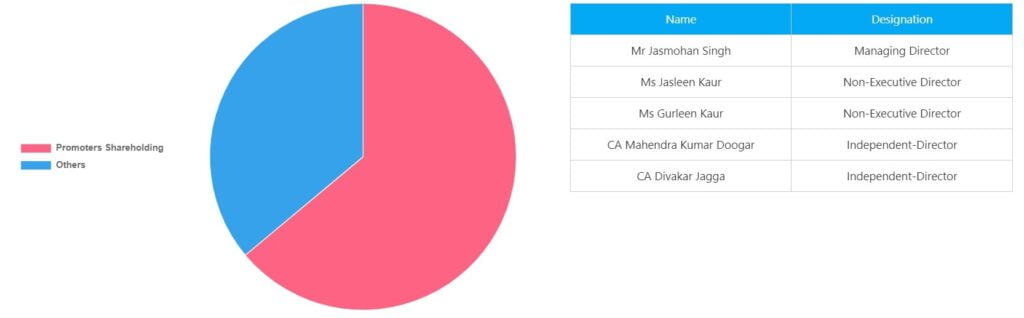

Frick India Unlisted Shares Board Members

Frick India Unlisted Shares Consolidated Results

Profit and Loss Statement

*figures in Cr. except EPS

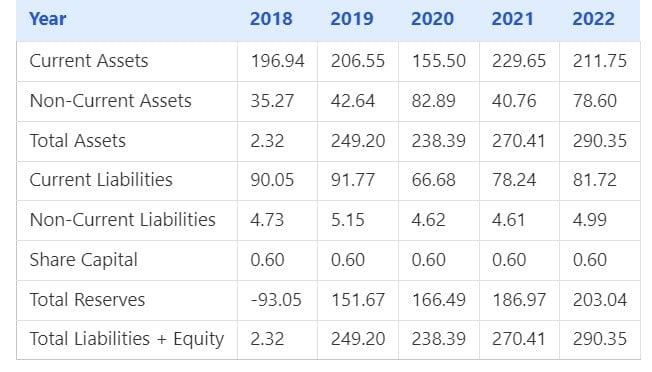

Balance Sheet

*figures in Cr.

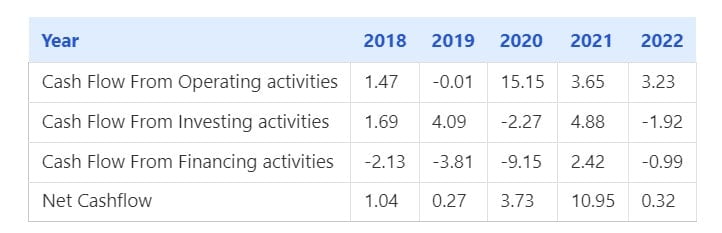

Cashflow

*figures in Cr.

- Opportunities

- Cold chains impart storage and distribution services for products that have to be maintained at a given temperature. India is currently the world's largest producer of milk, the second largest producer of fruits and vegetables, and has a substantial production of marine, meat, and poultry products. Most of these products are temperature-sensitive and require specific temperature ranges to be stored and transported. This has resulted in the establishment of a very large cold-chain infrastructure in the country.

- The surge in online grocery, processed food, and pharmaceutical sales has opened up ample opportunities for developers and third-party logistics players to develop multi-purpose cold chain facilities in India. The company is working hard to increase its domestic and international sales.

- Threats

- The company faces risk in terms of input costs. The raw material consumed by the company has been very volatile, and a sudden change can have an adverse impact on the company's operating margins. For this, it has set up many long-term contracts with its major OEM customer, where the raw material cost has been passed through.

Frick India Unlisted Shares News

Taparia Tools is a well-recognized name among manufacturers in the hand tools manufacturing industry and has been in the news lately for its gaining spree in the stock market. With a well-established history of over five decades, the company is considerably placed in India and various overseas markets. In this article, we will discuss the Taparia Tools company’s background, stock price history, and whether this is the right time for investment in Taparia Tools Share. Company Overview Taparia Tools Limited was established in 1965 and has since grown to be one of the largest Hand Tool manufacturers in India. The company produces a wide range of tools, including spanners, pliers, screwdrivers, hammers, and toolsets that cater to domestic and international markets. Its products are applied in many industries such as building, general DIY, and automotive repairs. It is headquartered in Mumbai, with its manufacturing plants located in Nashik, Maharashtra. Taparia Tools markets its products under the brand name “Taparia” and exports to countries like the United States, the United Kingdom, Germany, and many others in Europe, Asia, and South America. Its brand is highly regarded for being durable, accurate, and quality-based. Taparia Tools Share Price History One such stock that has recorded remarkable growth compared to other competitors in the Indian market is Taparia Tools. Further, this stock moved between ₹2.79 and ₹7.96 within a year, proving that it may be a little turbulent at times. Long-term investors in Taparia Tools have seen the company grow steadily, and the company has been regularly rewarding its shareholders through the issue of dividends. For instance, the company has reported an increase in earnings for these years consistently and declared an EPS of ₹ 65.73 in FY 2024 against ₹ 47.65 in FY 2023. It is these earnings that have boosted investor confidence, and Taparia Tools has emerged as one of those companies where investors can get assured returns in the long term. However, potential investors need to be aware that share prices could vary depending on the market conditions and the trends of the industry. These factors will need to be monitored continuously before any decisions are made to invest in shares. Taparia Tools Current Share Price The Taparia Tools Share Price, as of September 2024, is ₹7.96. The market capitalization of the company stands at ₹12 crore, hence making the stock fall under small-cap in the Indian stock market. That would also mean the company has tremendous scope for growth but at the same time may be more risky compared to other bigger companies. An important investment advantage of Taparia Tools is the fact that it is a debt-free company. The company has no outstanding debt and holds substantial cash reserves of ₹155 crore. This financial stability is a crucial measure of the company’s ability to withstand market volatility. Financial Performance and Investment Considerations The most important factor for any investment in Taparia Tools is its financial performance. It grows continuously with respect to revenue and profitability, thus making it a good long-term investment opportunity. With an aggregate revenue of ₹848 crore and a net profit of ₹387 crore over a period of ten years, Taparia Tools has established its capacity for stable earnings. Ownership Structure: Taparia Tools has promoter ownership at 69.72%, which tends to be a good sign that people running the business are fully committed and aligned with the interests of the shareholders. High levels of promoter holdings are generally perceived positively by investors because it indicates that the management is fully invested in the long-term perspective of the company. However, the liquidity of Taparia Tools stands on the lower side, and enough shares may not be available in the open market. This may lead to cases of price fluctuation, thereby making it trying for investors to get in or out at good prices. Factors That Have Caused Volatility and Growth in Share Price There are some factors that have combined to cause volatility and growth potential in the share price of Taparia Tools: 1. Demand for hand tools in the global platform: Not only do growth improvements continue to develop in developing markets, but growth also gains momentum in emerging sectors of building and construction and auto-repairing. This marks a good opportunity for Taparia Tools to expand the business. As the normalization of a pandemic-stricken global economy progresses, this company is well-positioned to see higher orders for its product offers. 2. Export Markets: Taparia Tools exports to many countries, including the high-demand markets of the US, UK, and Germany. Improvement in such export markets or new export markets may form a leapfrog step for the company’s turnover. 3. Financial Health: The fact that the company is debt-free and enjoys strong cash reserves puts it in a very enviable position to make future investments in technology, manufacturing capacity, or even marketing. Which easily can mean higher revenues and profits in the future. 4. Risks and Volatility: Such volatility of the stock, especially for short-term investors, is a cause of concern. As most of the small-cap stocks are frequently trending up or trending down in price, Taparia, too, can depict similar price aberrations. Investors with higher risk intolerance may think twice about this investment. Other Factors: 1. Dividend: Taparia Tools has been paying regular dividends to the shareholders during the last few years. This might be the largest positive for investors, who are seeking stable returns. However, income through dividends is never assured, and any prospective investor should be satisfied with all other risks before investing to get income through dividends. 2. Market Competition: Taparia Tools operates in a competitive market. Despite the company’s strong brand, there are more competitors in the global hand tool industry. To remain competitive in the market, the company will need to innovate and expand. 3. Long-term Investment: Apart from the strong financial position, Taparia Tools would be a good option for the long-term investor concerning the growth prospects. However, it would be more of the keyword regarding patience since the stock is

Based on GMV, PharmEasy is the biggest digital healthcare platform in India. It is the greatest platform for online consultations, diagnostic testing, and medication. With 25 million registered customers, 87,194 pharmacies, 3,261 wholesalers, 4,617 clinics, prescribing physicians, and 926 hospitals, PharmEasy is a well-known brand. The company works on advanced AI/ML to manage the workflow and improve its transactions. The unlisted share price of API Holding Ltd. (PharEasy) has experienced a significant decrease in the last few years. The share price dropped from Rs 135 to Rs 22. Despite the unclear circumstances surrounding the company’s rise, investors continue to place bets on the company and receive substantial returns. According to the RedSeer Report, the company, which was founded on March 31, 2019, is the biggest digital healthcare platform in India (based on the GMV of goods and services sold for the year that concluded on March 31, 2021). API Holdings runs a complete, integrated business with the goal of meeting consumer healthcare needs at the following important stages: supplying digital resources and health and wellness information, providing teleconsultation, providing radiological testing and diagnostics, administering treatment plans, and supplying goods and equipment. The PharmEasy marketplace is powered by the company’s unique technological platform, which also owns the “PharmEasy” trademark. The business has granted Aarman, which owns a 19.99% equity stake, a license to use the brand and the technology. The PharmEasy marketplace is managed by Axelia. PharmEasy Share Price Face Value ₹ 1 per share Current Ratio 3.67 Code ISIN INE0DJ201029 PharmEasy Unlisted Share Price ₹ 11/Share Net Profit ₹ -641 Cr Net Revenue ₹ 2360 Cr. ROE -33.51% Lot Size 500 shares Demat Status CDSL, NSDL Market Cap INR 15,972 Cr. Pharmeasy Share IPO Details Although the company had previously filed a DRHP, its preparations for an IPO were withdrawn. As of right now, there are no updates available on Pharmeasy’s IPO. In the unlisted market, Pharmeasy’s share price is now trading between Rs. 18 and Rs. 20. Business Segment of Pharmeasy Company In order to win the trust of different clients, the Pharmeasy online marketplace offers an online platform for security and updates customers easily about their services on a regular basis. This platform operates in a particular manner to guarantee that the drugs and services it offers are of the very best quality and are supplied on schedule. In the first phase of the PharmEasy business plan, the client provides the company with their prescription information. Before this prescription is delivered to a neighboring pharmacy for the customer’s use, it is examined using a certain set of criteria. PharmEasy has a variety of partnerships and authorized pharmacies with which it works to assess prescriptions, essential medications, and other benefits associated with the medication. After that, by the guidelines, a transport company will get the prescription and the drugs so that the pharmacy can confirm and check them. In certain cases, the chemist can also contact you if they have any issues with the prescription. The purchase is dispatched for delivery when it has been validated and examined. Strengths of Pharmaeasy Company The modern world has seen a rise in internet usage due to technological advancements, and many individuals now find it quite easy and simple to make purchases online. It helps firms like PharmEasy, which has been online from the day it was founded, particularly in considering the pandemic and the large number of other companies that have made the switch to the Internet. Valuation and Analysis of PharmEasy PharmEasy was founded in 2014 and obtained angel money in 2015. Following that, the creators took part in further funding rounds. The company’s goals after receiving money from the Series A round were to develop a home diagnostic service and grow its operations to five locations. After the fundraising round, PharmEasy launched its online platform for healthcare products and services, which covered over 700 cities. Clients have well received the platform. PharmEasy combined with Ascent Health and more firms in 2020 and 2021, forming API Holding Limited, the parent company. After that, it purchased a 66% stake in Thyrocare and became the first unlisted business to buy shares of a listed company. The pre-IPO market performance of PharmEasy is mostly influenced by its financial growth and decrease. In the last two years, the company’s expenses have also soared, rising from Rs 270 crore to Rs 1549 crore. In light of PharmEasy’s IPO announcement, investors should consider current performance while making selections. Experts predict that PharmEasy will grow at a pace of between 30 and 40 percent following the IPO. Before PharmEasy is listed on a stock exchange, you can purchase company shares that are unlisted. Why Should You Purchase Pharmeasy Unlisted Shares? Purchasing unlisted company shares is a fantastic method to lower risk and diversify an investment portfolio. PharmEasy intends to become public this year, so if you invest in its unlisted shares early, you can benefit from long-term profits. The low availability and significant growth potential of PharmEasy’s unlisted shares are further incentives to invest. But, while making an investment in PharmEasy, you should take both past and current performance into account equally. Looking for advice from specialists is the best course of action. You may get the best guidance on unlisted shares by getting in touch with our staff. Retail investors can purchase a variety of blue-chip companies on Stockify, a reliable marketplace for purchasing unlisted shares. Here you Conclusion Making informed decisions in 2024 requires investors to have a thorough understanding of the PharmEasy unlisted share price data. To get the most out of your investing plan, pay attention to market fluctuations and think about taking a diversified approach.

Boat (Imagine Market Ltd.) sells a variety of products, including wearables like smart watches, mobile accessories like cables and trimmers, wireless speakers, wired headphones, wired earphones, and wireless headphones. In addition to selling its goods offline, the company also offers them online through markets and its own website. 83.24% of the company’s items were sold through online marketplaces as of H1 2022, 13.84% through its own website, and 2.93% through traditional channels. The business is now concentrating on offline channels as well. By September 30, 2021, items were offered for sale in more than 23,000 retail locations throughout India. This was made possible by a retail network that included more than 180 sub-distributors and over 51 distributors operating in more than 32 states and union territories. The company competes with a number of domestic and foreign businesses in the industry in which it works. Our rivals include foreign and heritage audio companies, up-and-coming Indian brands, Chinese smartphone OEMs, and online marketplace private labels. The primary rivals of the business include Samsung, Realme, Oneplus, Noisy, Nothing, and others. Industry Description BoAt Share Price The boat has had significant financial growth in the last few years. In recent years, the company has experienced profitable growth. Boat recorded revenue of Rs 4000 crore for FY23, a 40% increase from the previous year. Boat recorded revenue of Rs 2886 Cr and profit of Rs 78 Cr for FY22. ISIN NUMBER INE03AV01027 FACE VALUE ₹ 1 Current Ratio 1.23 EPS ₹ 5.09 P/E Ratio 167.97 NET REVENUE ₹ 2886 Cr. NET PROFIT ₹ 78.82 Cr. ROE 14.79% BoAt Unlisted Share IPO Details The company had intended to raise about Rs 2000 crore through an IPO (initial public offering) and submitted its Draft Red Herring Prospectus (DRHP) with the SEBI on January 26, 2022. However, the business has now postponed its initial public offering (IPO) plan, and Boat has opted to use a private placement to acquire 500 million dollars from two sources: a new investor, Malabar Investments, and an affiliate of the international private equity firm Warburg Pincus. The money will be raised through preference shares. Valuation and Analysis Of Boat As Boat dropped its IPO plans, it raised these funds. The company raised this money at a price of Rs 750 per share at a time when its revenue was INR 2800 crore. As of FY23, boat revenue has increased to almost INR 4000 crore. In order to satisfy demand, Boat plans to use these funds to expand its production plant. The price of boat shares on the unlisted market has also grown as a result. The business is expanding profitably and at a very rapid pace. How To Buy BoAt Unlisted Share Price With BharatInvest? The process for purchasing BoAt unlisted Shares/Pre-IPO shares at Bharat Invest is shown below: Strengths Of Boat Unlisted Shares How to sell BoAt Unlisted Shares/Pre-IPO shares with BharatInvest? The process for selling BoAt Unlisted Shares/Pre-IPO shares at Bharat Invest can be found below. Conclusion Investors need to understand the Boat share price data thoroughly in order to make wise decisions in 2024. Consider adopting a diversified strategy and be aware of market trends if you want to increase the returns on your investment plan.

Frick India Unlisted Shares FAQs

Please find below the procedure for buying Frick India Ltd Unlisted Shares/Pre-IPO shares at Bharat Invest.

- You confirm booking of Frick India Ltd Unlisted Shares/Pre-IPO shares with us at a specified price.

- You have to provide your client master report along with PAN Card and Cancelled Cheque in case you are not transferring funds from the bank account as mentioned in the CMR Copy. These are KYC documents required as per SEBI regulations.

- We will provide our bank details.

- You need to transfer funds in the current account of bharatinvest.

- No cash deposit is accepted

- Payment has to be done from the same account in which shares are to be credited.

- We ensure delivery of Frick India Ltd unlisted shares within 24 hours.

- Incase of non-availability of shares, we refund the amount to the same bank account within 24 hours.

- For detailed discussion, you can contact us via any medium.

Please find below the procedure for selling Frick India Ltd Unlisted Shares/Pre-IPO shares at Bharat Invest.

- We will confirm our buying price of Frick India Ltd Unlisted Shares/Pre-IPO shares.

- We will give you our client master report and you will transfer the Frick India Ltd Unlisted Shares/Pre-IPO shares to our demat account.

- We will transfer the funds in your bank account within 24 hours of receiving the Frick India Ltd Unlisted Shares/Pre-IPO shares.

- All the transactions will be bank to bank.

- Payment will be given in the same account which is linked to demat account or you need to provide the cancelled cheque shows your name to verify.

- You can contact us through any medium for a detailed discussion.

- The lockin period is of 6 months for pre-ipo investors i.e. they cannot sell their shares for 6 months after they get listed. However, they can definitely sell the shares in pre-ipo market before they get listed.

- With BharatInvest , you can now invest in unlisted/pre-ipo shares with as low as 25-50k depending upon the share.

- You can download the NSDL or CDSL application and login into the account and check whether the shares have been credited or not.

- Credit of Unlisted Shares/Pre-IPO shares Unlisted Shares can be checked in brokers application as well but it takes T+2 days to show the shares.

- The value of share in unlisted space is determined in the same way as it is done in listed market. Demand and supply decide the price of any share. If the demand more than the supply, then the prices of the share increases and vice versa.

- When a new shares is introduces in the unlisted space, the value of the company is decided upon the last funding raised by company. If the company hasn’t raised any funding in the past, then the valuation is decided upon the fundamentals of the company.

- All the transactions are done DEMAT to DEMAT. All the unlisted shares traded with us are available in demat accounts and are transferred to your demat within 24 hours of payment.

Bharatinvest is India’s leading investment bank. Here you can invest unlisted, pre-ipo or delisted shares of Frick India at best price. At Bharatinvest, you will get all the updates regarding Frick India unlisted share price, IPO news, IPO price, GMP, Frick India share news, events, dividends, company related news, ISIN, lot size, Financials ( Frick India Profit and loss statement, Frick India Balance Sheet, Frick India cash flow statement ), Peer comparision and analyst views. Investing in Frick India share before ipo can help you invest in shares when they are available at low prices. Holding them on long term basis will help you create wealth in long term and enjoy compounding benefits. Our investors have made an average 250% returns by investing in pre-ipo shares. Buy Frick India unlisted or Pre-ipo share at best price from our tech-platform today. You can connect with our expert financial advisors for any guidance.