Lava Unlisted Share Company Details

ISIN NUMBER

INE745X01022

FACE VALUE

₹ 5

Current Ratio

2.72

EPS

₹ 3.46

P/E Ratio

38.4

NET REVENUE

₹ 5523 Cr.

NET PROFIT

₹ 172 Cr.

ROE

11.52%

Cashflow from Operations

₹ 151 Cr.

About Lava Unlisted Share

- Lava International Limited is a leading mobile handset company in India and has expanded its operations to multiple countries such as India, Thailand, Indonesia ,Mexico ,China ,Egypt the Middle East, Nepal, Bangladesh, Sri Lanka, Dubai, Hong Kong, Singapore, the USA , Kuwait, Bahrain, Oman,Qatar, Romania, China,Papua New Guinea, China, Switzerland,British Virgin Islands, Taiwan, Somalia, Mauritius, Ireland, Israel,Sweden, Greece, and many more.

- The company manufactures and assembles mobile handsets at its own manufacturing facility located in Noida, India (the “Noida Facility”), using surface-mount technology (“SMT”), which is a leading technology in mobile handset manufacturing. As of August 31, 2021, the company had four SMT lines and 12 assembly lines operated by 3,105 workers, with a production capacity of 42.52 million Feature Phone Equivalent handsets per annum.

- The company offers a wide range of products under our own “LAVA” and “XOLO” brands, including feature phones, smartphones, tablets, and other electronic accessories such as data cards, chargers, audio products (including headphones and true wireless stereo (“TWS”) earbuds), and smart wearables (including smart bands and smart watches), which complement our mobile handset offering and provide value-added software services such as Lava Pay and Lava Pulse.

- Company also offers mobile handset solutions to OEMs ranging from sourcing, design, manufacturing, quality testing, embedding software, and distribution. In the past, company has customised and manufactured mobile handsets to be sold under the brands of leading multi-national companies such as HMD, Bhagwati Products Limited, and TCL. For GE Healthcare, they also designed smartphones with medical ultrasound applications.

- Lava is now the only mobile handset company that makes truly “Make in India” phones with complete control over design and manufacturing within India. Lava was also ranked as the “Most Trustworthy Brand” in the CMR Retail Sentiment Index 2018.The company has established an extensive distribution network with a wide geographical reach in India through four channels of distribution:

- General trade: Company primarily sells its products through the general trade channel, where they supply their products directly to the distributors and retailers, who in turn sell them to end-customers. Company’s domestic network consisted of 893 active distributors and 116,339 active retailers as of July 31, 2021, which provides us with significant depth and breadth of product distribution in India’s largest cities as well as in tier 2 and tier 3 cities and enables us to roll out new products more quickly.

- Online/e-commerce: Our products are also sold through e-marketplaces such as Flipkart and our Lava e-store on lavamobiles.com.

- Organized/modern trade: Modern trade retail stores such as Poorvika Mobiles Private Limited, Sangeetha Mobiles Private Limited, Vijay Sales India Private Limited, B New Mobiles Private Limited, Big C Mobiles Private Limited, Lot Mobiles Private Limited, Sri Lakshmi Enterprises, Appario Retail Private Limited, and other hypermarket stores sells the products of the company.

- B2B channel: B2B customers include a telecommunications operator, government departments, and other institutions.

- Recently, the company has successfully signed

- a partnership licence agreement with Lenovo, which entitles us to distribute mobile handsets manufactured by us under the Motorola brand in India and overseas;

- a multi-year contract with HMD for end-to-end design, manufacturing, supply chain, and distribution of mobile handsets under the Nokia brand in India and overseas.

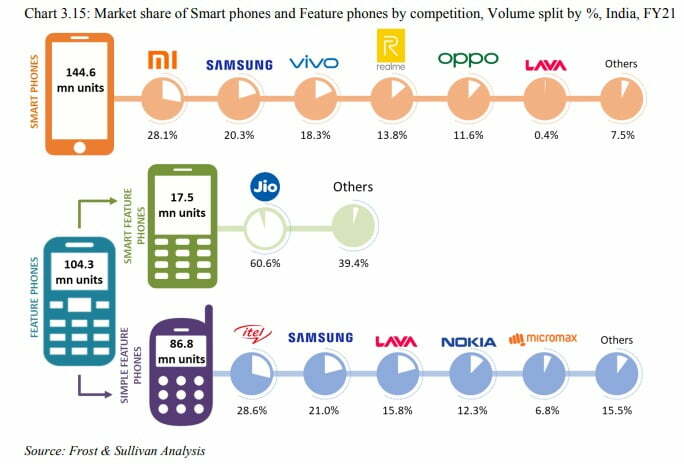

- According to F&S, Lava is the third largest feature phone company in India with a market share of 13.4%, in terms of sales volume in the financial year 2021.

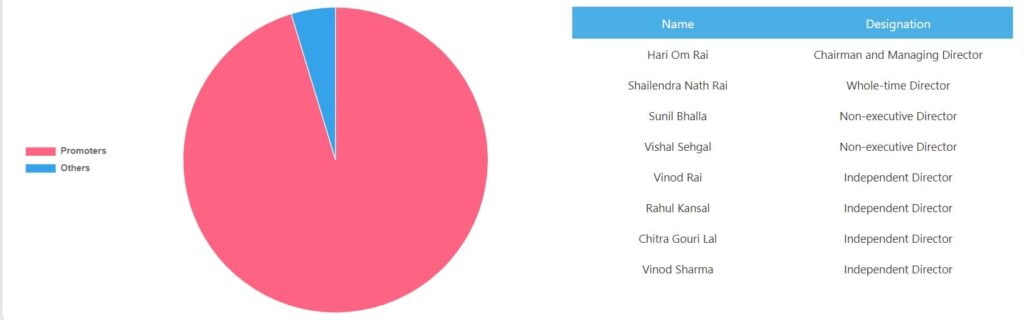

- The company was co-founded by Hari Om Rai with Shailendra Nath Rai and Sunil Bhalla in 2009, and Vishal Sehgal joined the company in 2010. It has its head office in Noida.

Lava Unlisted Share IPO Details

The company has filed DRHP (Draft red herring prospectus) and the public offer of Lava International comprises a fresh issue of equity shares aggregating up to Rs. 500 crores and an offer for sale of 4.37 crore equity share

LAVA share price is trading in the range of Rs. 110-125 in the unlisted market

Lava Unlisted Share Price

Lava share price is decided on the basis of it’s funding round that it raised from it’s investors. After that, price is decided by the forces of demand and supply as same as listed market. Lava share price is Rs 110 per share with a face value of Rs 5.

Lava Unlisted Peers

Following are the close Listed Peers of the company:

Lava Unlisted Valuation and Analysis

Lava Unlisted Share Subsidiaries

a) Lava Enterprises Limited

b) Sojo Distribution Private Limited

c) Sojo Manufacturing Services (AP) Private Limited

d) Sojo Manufacturing Services Private Limited

e) Lava Technologies LLC, USA

f) XOLO International (HK) Limited, Hong Kong

g) Lava International (H.K.) Limited, Hong Kong

h) Lava Technologies DMCC (Dubai)

i) Lava Mobility (Private) Limited, Sri Lanka

j) Lava International (Nepal) Private Limited, Nepal

k) Lava International DMCC, UAE

l) Lava Mobile Mexico, S. DE R.L.DE C.V, Mexico

m) Lava International (Myanmar) Company Limited, Myanmar

n) PT. Lava Mobile Indonesia, Indonesia

o) Lava International (Bangladesh) Limited, Bangladesh

p) China Bird Centro America, S.A

Lava Unlisted Share Board Members

Lava Unlisted Share Consolidated Results

Profit and Loss Statement

*figures in Cr. except EPS

Balance Sheet

*figures in Cr.

Cashflow

*figures in Cr.

- Strengths

- The company has a Leading End-to-End Focused Mobile Handset and Mobile Handset Solutions Company in India with Growing International Presence

- Robust research and development capabilities with a strong track record in product innovation and design

- Large-scale State-of-the-Art Manufacturing and Quality Service Capabilities

- Extensive Distribution Network Supported by Advanced Information Technology Capabilities

- Highly Qualified and Experienced Leadership Team and Motivated and Skilled Workforce

- Limitations

- Key risks for mobile phone market in India Under-developed ecosystem resulting in reliance on imports: Currently the value chain for smartphone in domestic manufacturing is underdeveloped.

- Competitive pricing: Chinese brands have swept the Indian mobile phone market with their competitive prices.

- Technology shift: India is still in the testing phase of 5G technology, which needs to be paced with the global market.

- India spent just 0.65% of its gross domestic product (GDP) in 2020 on R&D. Meanwhile, Japan, the US and China spent 3.73%, 2.94% and 2.40%, respectively, in 2022

Lava Unlisted Share News

In an excellent feat, Indian mobile phone producer Lava Global has secured an outstanding region inside the Guinness global information by using crafting the largest mosaic composed of smartphones, ingeniously forming the shape of the Indian Flag. The groundbreaking document became hooked up inside the premises of a Noida mall, positioned in Uttar Pradesh, the usage of the progressive Lava Blaze 2 smartphones. A Guinness global statistics adjudicator was on-web the page to formally verify and certify this momentous accomplishment, ensuring that the phone mosaic absolutely merited the name of a new international document. Sunil Raina, the esteemed President and enterprise Head of Lava Worldwide shared his profound pleasure in India’s triumph of creating the biggest animated cell phone mosaic, symbolizing the Indian Flag’s outline. This superb achievement serves as a powerful tribute to the nation on the occasion of its 77th Independence Day. Raina emphasized that this triumph magnificently celebrates the success of Agni 2, an emblem of Indian technological prowess that effectively debunked the false impression surrounding the capacity of Indian tech merchandise. Furthermore, he expressed enormous pleasure in his personal organization for spearheading this groundbreaking success. Lava International, renowned for its prowess in crafting cellular gadgets, boasts a sophisticated manufacturing and repair facility situated in Noida. This facility showcases the amazing capacity to yield a marvelous 42. Fifty-two million function smartphone equivalent handsets yearly, a statistic as of August 31, 2021. Past its feat within the feature telephone realm, Lava has unleashed a numerous spectrum of present-day smartphones, which include the Lava Agni 2, Lava Blaze 5G, and Lava Yuva 2 seasoned. The organization’s great boom is underscored through an outstanding fifty-three% yr.-on-yr. growth at some point in the second zone of 2023, in keeping with Counterpoint research. Evidently, Lava International is dedicated to augmenting its product portfolio to cater to the dynamic desires of the burgeoning Indian market. Bolstered via a sturdy manufacturing and restoration facility, the corporation is strategically located to preserve its trajectory of the boom, cementing its foothold and capturing a more and more extensive marketplace percentage. For the latest updates on Lava‘s revolutionary ventures and its groundbreaking fulfilment in securing the Guinness World document for the most important telephone mosaic depicting the Indian Flag, live tuned with Bharat make investments , the gold standard cellular application facilitating seamless funding in mutual price range and various monetary merchandise. Discover an international wherein technological marvels and financial acumen converge to form a brighter future.

Lava International , one of the leading Indian mobile phone manufacturers, was recently directed by the Securities and Exchange Board of India (SEBI) to refile its IPO papers. The move has raised concerns among investors who were eagerly awaiting the company’s IPO. The SEBI’s decision to ask Lava International to refile its IPO papers was based on certain discrepancies in the company’s financial statements. SEBI found that the company had not provided adequate details about its financials in the draft red herring prospectus (DRHP) that it had filed earlier. The regulatory body also found that Lava International had not disclosed certain critical aspects of its business operations. The move has come as a setback for the company, which was planning to raise funds through an IPO to expand its operations and compete with other mobile phone manufacturers in the country. However, SEBI’s decision to ask the company to refile its papers does not mean that the IPO has been cancelled. Lava International can still go ahead with its IPO plans once it has addressed the concerns raised by SEBI. The decision to refile IPO papers is not uncommon in the Indian capital markets. SEBI is known for its strict regulations and scrutiny of IPO filings to protect investors’ interests. SEBI’s directive to Lava International is a reminder to companies that they need to be transparent and provide accurate and complete information in their IPO filings. Investors who were planning to invest in Lava International’s IPO should not be discouraged by this development. Instead, they should take it as a positive sign that SEBI is taking steps to ensure that companies provide accurate information to investors. Once Lava International refiles its IPO papers, investors will have the opportunity to assess the company’s financials and business operations in detail before making an investment decision. CONCLUSION SEBI’s directive to Lava International to refile its IPO papers may delay the company’s IPO plans, but it is a necessary step to ensure that investors are protected. Companies planning to go public should ensure that they provide accurate and complete information in their IPO filings to avoid any delays or regulatory action. Reliance Retail share price as of 04/05/2023 is Rs 133. Get regular updates on LAVA share Price , unlisted shares only on Bharat Invest.

Lava Share Price as of 22-02-2023 is trading at RS. 133 in the unlisted market. You can connect with bharatinvest to invest in Lava’s share. Get regular updates on Lava share, share price, news, corporate actions Expanding its smartphone line-up, homegrown electronics maker Lava International launched the Yuva 2 Pro smartphone in the country on February 21. Priced at Rs 7,999, the smartphone is available for purchase on the company’s online store and select e-commerce platforms. Lava recently announced its partnership with Edtech platform Doubtnut, and the Yuva 2 Pro is its first smartphone to come pre-loaded with free subscription of Doubtnut’s course material for students in classes 9th to 12th (worth up to Rs 12,000 for one year). The Lava Yuva 2 Pro is powered by MediaTek Helio G37 system-on-chip. The smartphone sports a 6.5-inch HD+ resolution screen with a notch to accommodate the front camera. It has a side mounted fingerprint sensor and boasts USB type-C port for charging and data transfers. The Lava Yuva 2 Pro sports a triple-camera array on the back, featuring a 13-megapixel primary camera sensor supported by artificial intelligence. On the front, the phone has a 5MP camera sensor for selfies and videos. The smartphone is offered in 4GB RAM and 64GB on-board storage configuration. It boasts virtual RAM feature, which allows using up to 3GB storage space as RAM for keeping active low-priority apps in the background. The Lava Yuva 2 Pro is powered by a 5,000 mAh battery. It is offered in glass white, glass lavender, and glass green colours. Other features include anonymous call recording. Lava is offering a ‘free service at home’ option for customers to avail after sale services at the comfort of home. REPORT: Lava Unlisted share Source: Business Standard

Lava Unlisted Share FAQs

Please find below the procedure for buying Lava Unlisted Shares/Pre-IPO shares at Bharat Invest.

- You confirm booking of Lava Unlisted Shares/Pre-IPO shares with us at a specified price.

- You have to provide your client master report along with PAN Card and Cancelled Cheque in case you are not transferring funds from the bank account as mentioned in the CMR Copy. These are KYC documents required as per SEBI regulations.

- We will provide our bank details.

- You need to transfer funds in the current account of bharatinvest.

- No cash deposit is accepted

- Payment has to be done from the same account in which shares are to be credited.

- We ensure delivery of Lava unlisted shares within 24 hours.

- Incase of non-availability of shares, we refund the amount to the same bank account within 24 hours.

- For detailed discussion, you can contact us via any medium.

Please find below the procedure for selling Lava Unlisted Shares/Pre-IPO shares at Bharat Invest.

- We will confirm our buying price of Lava Unlisted Shares/Pre-IPO shares.

- We will give you our client master report and you will transfer the Lava Unlisted Shares/Pre-IPO shares to our demat account.

- We will transfer the funds in your bank account within 24 hours of receiving the Lava Unlisted Shares/Pre-IPO shares .

- All the transactions will be bank to bank.

- Payment will be given in the same account which is linked to demat account or you need to provide the cancelled cheque shows your name to verify.

- You can contact us through any medium for a detailed discussion.

- The lockin period is of 6 months for pre-ipo investors i.e. they cannot sell their shares for 6 months after they get listed. However, they can definitely sell the shares in pre-ipo market before they get listed.

- With BharatInvest , you can now invest in unlisted/pre-ipo shares with as low as 25-50k depending upon the share.

- You can download the NSDL or CDSL application and login into the account and check whether the shares have been credited or not.

- Credit of Unlisted Shares/Pre-IPO shares Unlisted Shares can be checked in brokers application as well but it takes T+2 days to show the shares.

- The value of share in unlisted space is determined in the same way as it is done in listed market. Demand and supply decide the price of any share. If the demand more than the supply, then the prices of the share increases and vice versa.

- When a new shares is introduces in the unlisted space, the value of the company is decided upon the last funding raised by company. If the company hasn’t raised any funding in the past, then the valuation is decided upon the fundamentals of the company.

- All the transactions are done DEMAT to DEMAT. All the unlisted shares traded with us are available in demat accounts and are transferred to your demat within 24 hours of payment.

Bharatinvest is India’s leading investment bank. Here you can invest unlisted, pre-ipo or delisted shares of LAVA at best price. At Bharatinvest, you will get all the updates regarding LAVA unlisted share price, IPO news, IPO price, GMP, LAVA share news, events, dividends, company related news, ISIN, lot size, Financials ( LAVA Profit and loss statement, LAVA Balance Sheet, LAVA cash flow statement ), Peer comparision and analyst views. Investing in LAVA share before ipo can help you invest in shares when they are available at low prices. Holding them on long term basis will help you create wealth in long term and enjoy compounding benefits. Our investors have made an average 250% returns by investing in pre-ipo shares. Buy LAVA unlisted or Pre-ipo share at best price from our tech-platform today. You can connect with our expert financial advisors for any guidance.