Reliance Retail Unlisted Share Company Details

ISIN NUMBER

INE742O01010

FACE VALUE

₹ 10

Current Ratio

0.92

EPS

₹9.28

P/E Ratio

285

NET REVENUE

₹ 170155 Cr.

NET PROFIT

₹ 4937 Cr.

ROE

17.67%

Cashflow from Operations

₹ 1674 Cr.

About Reliance Retail Unlisted Share

- Reliance Retail is a subsidiary of Reliance Industries Limited and is India’s largest and most profitable retailer with a diverse omni-channel presence via integrated store concepts and digital commerce platforms, providing consumers with an outstanding value proposition, superior brands and quality, and an unrivalled shopping experience.

- The company operates in consumer electronics, fashion and lifestyle, grocery, pharma, and connectivity, and is a leader in all the focus consumption baskets. As of March 31, 2022, the company operated 14,385 stores with 39 million sq. ft. of retail space, having a physical presence across more than 7,000 cities in India and direct-to-customer delivery capabilities across 19,000+ pin codes.

- Reliance Retail serves millions of customers each year and has one of the largest and fastest-growing customer franchises in the world, with 193 million loyalty customers transacting across our offline and online channels.

- Reliance Retail has built a strong portfolio of own-brand products across food, FMCG, general merchandise, fashion, and consumer electronics categories that offer superior feature quality and price propositions to leading brands by combining its deep customer insights, rich market knowledge, and wide retail reach.

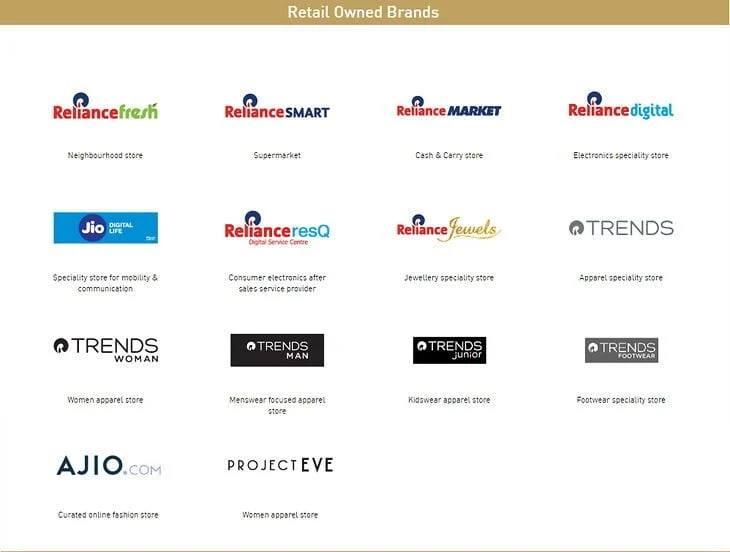

- The following brands are as under Reliance Retail :

- With over 120,000 transactions per hour, Reliance Retail operates at a scale unparalleled in the Indian retail industry and continues to enrich the quality of life for millions of Indians every day.

During the year, over 2,000 stores were opened, bringing the total count to 14,385 stores with a total area of 39 million sq. ft., extending its leadership position further into tier II and III markets while more than doubling its warehousing and fulfilment capabilities across the board.

Reliance Retail Brands:

• Reliance Smart

• Reliance Smart Point

• JioMart

• Reliance Digital

• JioMart Digital

• Jio Store

• Reliance Trends

• Reliance Consumer Brands

• 7-Eleven

• Project Eve

• Trends Footwear

• Reliance Jewels

• AJIO

• Hamleys

• Reliance Brands

• Reliance Mal

Peers: Dmart, Vmart, Bigbasket etc.

Market Statistics:

- After the pandemic, the retail sector is expected to rebound and record a compounded growth rate of 11% to become a US$ 1.2 trillion market by 2025.

Reliance Retail Unlisted Share IPO Details

The company has no plans to go public as of now.

Reliance Retail Unlisted Share Price

Reliance Retail share price is decided on the basis of it’s funding round that it raised from it’s investors. After that, price is decided by the forces of demand and supply as same as listed market. Relaince Retail share price is Rs 1350 per share with a face value of Rs 10.

Reliance Retail Peers

Following are the close Listed Peers of the company:

Reliance Retail Valuation and Analysis

Reliance Retail Unlisted Share Subsidiaries

- Reliance Clothing India Private Limited

- Reliance Petro Marketing Limited

- Reliance Jio Infocomm Limited

- Genesis La Mode Private Limited

- Reliance Projects and Property Management Services Limited

- Shri Kannan Departmental Store Limited (Formerly Shri Kannan Departmental Store Private Limited)

- Actoserba Active Wholesale Limited (Formerly Actoserba Active Wholesale Private Limited)

- Marks and Spencer Reliance India Private Limited and many more.

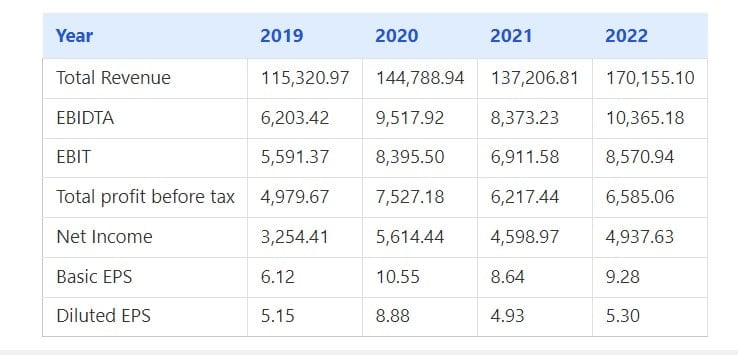

Reliance Retail Unlisted Share Consolidated Results

Profit and Loss Statement

*figures in Cr Except EPS

Balance Sheet

*figures in Cr

Cashflow

*figures in Cr

- Strengths

- The company has a Leading End-to-End Focused Mobile Handset and Mobile Handset Solutions Company in India with Growing International Presence

- Robust research and development capabilities with a strong track record in product innovation and design

- Large-scale State-of-the-Art Manufacturing and Quality Service Capabilities

- Extensive Distribution Network Supported by Advanced Information Technology Capabilities

- Highly Qualified and Experienced Leadership Team and Motivated and Skilled Workforce

- Limitations

- Key risks for mobile phone market in India Under-developed ecosystem resulting in reliance on imports: Currently the value chain for smartphone in domestic manufacturing is underdeveloped.

- Competitive pricing: Chinese brands have swept the Indian mobile phone market with their competitive prices.

- Technology shift: India is still in the testing phase of 5G technology, which needs to be paced with the global market.

- India spent just 0.65% of its gross domestic product (GDP) in 2020 on R&D. Meanwhile, Japan, the US and China spent 3.73%, 2.94% and 2.40%, respectively, in 2022

Reliance Retail Unlisted Share News

METRO, the global retail giant, has successfully completed a significant ₹2,850 crore deal with Reliance Retail to sell its Cash & Carry business in India. This strategic move allows Reliance Retail to further strengthen its presence in the Indian retail market. The deal signifies a significant milestone for both companies, enabling METRO to focus on its core operations while providing Reliance Retail with an opportunity for expansion. The acquisition of METRO’s Cash & Carry business will enhance Reliance Retail’s offerings and strengthen its position as a key player in the industry. For investors interested in the retail sector, this development may spark interest in Reliance Retail’s unlisted shares. As the company continues to expand its footprint and diversify its operations, investing in Reliance Retail’s unlisted shares presents an opportunity to be part of its growth journey. Investors considering the purchase of unlisted shares should conduct thorough research, evaluate market trends, and seek expert advice. Understanding the company’s financial performance, growth prospects, and future plans is essential for making informed investment decisions. Reliance Retail and METRO deal Conclusion The completion of the ₹2,850 crore deal between METRO and Reliance Retail signifies a significant shift in the Indian retail landscape. Reliance Retail’s acquisition of METRO’s Cash & Carry business presents an opportunity for investors to explore the potential of its unlisted shares. As the retail industry continues to evolve, investing in Reliance Retail’s unlisted shares allows individuals to align their investments with a prominent player in the market and potentially benefit from its future growth.

Reliance Retail, the retail arm of Reliance Industries, has acquired two Sri Lankan biscuit brands, Raskik and Toffee, in partnership with Maliban, a leading biscuit manufacturer in Sri Lanka. The move is expected to strengthen Reliance Retail’s position in the biscuit and snack segment in the South Asian market. The acquisition of Raskik and Toffee is part of Reliance Retail’s strategy to expand its product portfolio and tap into new markets. The two brands have a strong presence in Sri Lanka and are known for their high-quality products and innovative flavors. Reliance Retail’s partnership with Maliban is expected to bring significant synergies, combining Reliance Retail’s marketing and distribution expertise with Maliban’s deep understanding of the Sri Lankan market. The partnership will also provide Reliance Retail with access to Maliban’s manufacturing facilities, enabling it to leverage the company’s capabilities to produce its own brands in Sri Lanka. The acquisition of Raskik and Toffee also reflects Reliance Retail’s commitment to sustainable growth and responsible business practices. The two brands are known for their ethical and sustainable production practices, and Reliance Retail plans to build on this legacy by investing in sustainable production methods and responsible sourcing of raw materials. In a statement, Mukesh Ambani, the chairman of Reliance Industries, said that the partnership with Maliban and the acquisition of Raskik and Toffee are part of Reliance Retail’s larger vision to become a global leader in the food and beverage industry. He further stated that the South Asian market is a high-potential growth area, and Reliance Retail is committed to tapping into this market with innovative and sustainable products. Conclusion of Reliance Retail Reliance Retail‘s acquisition of Raskik and Toffee in partnership with Maliban is a significant step towards expanding its presence in the South Asian market. The partnership is expected to bring significant synergies, enabling Reliance Retail to leverage Maliban’s manufacturing capabilities and market expertise to reach a wider audience. With a focus on sustainable production methods and responsible sourcing of raw materials, Reliance Retail is well-positioned to become a leader in the food and beverage industry in the region. Reliance Retail share price as of 28/04/2023 is Rs 2400. Get regular updates on Reliance Retail share Price , unlisted shares only on Bharat Invest.

Reliance Retail, the retail arm of Reliance Industries, has announced its entry into the toy manufacturing sector with a new joint venture. The company has partnered with a leading toy manufacturer to create a new entity that will focus on designing, manufacturing, and distributing toys in India. This move is in line with Reliance Retail’s commitment to diversifying its product portfolio and tapping into new markets. The toy manufacturing sector in India has enormous growth potential, and Reliance Retail’s entry is expected to bring significant disruption and innovation to the industry. The new joint venture will leverage Reliance Retail’s extensive distribution network and marketing expertise to reach a wider audience. It will also benefit from the partner company’s years of experience in the toy manufacturing industry, ensuring that the products meet the highest quality standards. According to Mukesh Ambani, the chairman of Reliance Industries, the toy manufacturing industry is a crucial part of the “Make in India” initiative. He further stated that the new joint venture is a step towards creating a self-reliant India by building local manufacturing capabilities and reducing reliance on imports. The partnership with a leading toy manufacturer is also a significant milestone for Reliance Retail, reflecting its growing presence in the Indian market. The company has been expanding aggressively in recent years, with a focus on digital commerce and omnichannel retail. Conclusion Reliance Retail’s entry into the toy manufacturing sector is a bold move that is expected to bring significant changes to the industry. The new joint venture, with its focus on quality, innovation, and local manufacturing, is well-positioned to capture a significant share of the market. With Reliance Retail’s extensive distribution network and marketing expertise, the venture is expected to reach a wide audience and contribute to the growth of the “Make in India” initiative.

Reliance Retail Unlisted Share Documents

Reliance Retail Unlisted Share FAQs

Please find below the procedure for buying Reliance Retail Unlisted Shares/Pre-IPO shares at Bharat Invest.

- You confirm booking of Reliance Retail Unlisted Shares/Pre-IPO shares with us at a specified price.

- You have to provide your client master report along with PAN Card and Cancelled Cheque in case you are not transferring funds from the bank account as mentioned in the CMR Copy. These are KYC documents required as per SEBI regulations.

- We will provide our bank details.

- You need to transfer funds in the current account of bharatinvest.

- No cash deposit is accepted

- Payment has to be done from the same account in which shares are to be credited.

- We ensure delivery of Reliance Retail unlisted shares within 24 hours.

- Incase of non-availability of shares, we refund the amount to the same bank account within 24 hours.

- For detailed discussion, you can contact us via any medium.

Please find below the procedure for selling Reliance Retail Unlisted Shares/Pre-IPO shares at Bharat Invest.

- We will confirm our buying price of Reliance Retail Unlisted Shares/Pre-IPO shares.

- We will give you our client master report and you will transfer the Reliance Retail Unlisted Shares/Pre-IPO shares to our demat account.

- We will transfer the funds in your bank account within 24 hours of receiving the Reliance Retail Unlisted Shares/Pre-IPO shares.

- All the transactions will be bank to bank.

- Payment will be given in the same account which is linked to demat account or you need to provide the cancelled cheque shows your name to verify.

- You can contact us through any medium for a detailed discussion.

The lockin period is of 6 months for pre-ipo investors i.e. they cannot sell their shares for 6 months after they get listed. However, they can definitely sell the shares in pre-ipo market before they get listed.

With BharatInvest , you can now invest in unlisted/pre-ipo shares with as low as 25-50k depending upon the share.

- You can download the NSDL or CDSL application and login into the account and check whether the shares have been credited or not.

- Credit of Unlisted Shares/Pre-IPO shares can be checked in brokers application as well but it takes T+2 days to show the shares.

- The value of share in unlisted space is determined in the same way as it is done in listed market. Demand and supply decide the price of any share. If the demand more than the supply, then the prices of the share increases and vice versa.

- When a new shares is introduces in the unlisted space, the value of the company is decided upon the last funding raised by company. If the company hasn’t raised any funding in the past, then the valuation is decided upon the fundamentals of the company.

All the transactions are done DEMAT to DEMAT. All the unlisted shares traded with us are available in demat accounts and are transferred to your demat within 24 hours of payment.

Bharatinvest is India’s leading investment bank. Here you can invest unlisted, pre-ipo or delisted shares of RELIANCE RETAIL at best price. At Bharatinvest, you will get all the updates regarding RELIANCE RETAIL unlisted share price, IPO news, IPO price, GMP, RELIANCE RETAIL share news, events, dividends, company related news, ISIN, lot size, Financials ( RELIANCE RETAIL Profit and loss statement, RELIANCE RETAIL Balance Sheet, RELIANCE RETAIL cash flow statement ), Peer comparision and analyst views. Investing in RELIANCE RETAIL share before ipo can help you invest in shares when they are available at low prices. Holding them on long term basis will help you create wealth in long term and enjoy compounding benefits. Our investors have made an average 250% returns by investing in pre-ipo shares. Buy RELIANCE RETAIL unlisted or Pre-ipo share at best price from our tech-platform today. You can connect with our expert financial advisors for any guidance.