Axles India Ltd Unlisted Shares Company Details

ISIN NUMBER

INE701C01011

NET PROFIT

₹ 52.64 Cr

FACE VALUE

₹ 10

EPS

₹ 20.66

P/E Ratio

13.55

NET REVENUE

₹ 745 Cr.

About Axles India Ltd Unlisted Shares

- The company is in the business of manufacturing axle housing for global vehicle manufacturers with sales in India and outside India.

- Axles India is a joint venture of Wheels India, Sundaram Finance, and Dana Holding Corporation, USA. Axles India has the capability to provide axel housings for the entire range of medium and heavy commercial vehicles.

- Axles India commenced production at its Sriperumbudur plant, with an annual volume of 10,000 axle housings for Ashok Leyland. In 1995, to meet the increased demand of domestic OEMs, an additional facility for axle housings was set up at Cheyyar. In 2003, facilities to manufacture drive head assemblies were installed. In 2006, an export-oriented unit (EOU) was established to cater to export markets. In 2011, Drive Head’s business was sold to Dana India Private Limited.

- Axles India supplies vehicles to Tata Motors, Ashok Leyland, VE Commercial Vehicles, Dana India Private Limited, SML Isuzu, Mahindra Trucks and Buses, and Daimler India Commercial Vehicles. Axles India also exports to Dana USA and Volvo Trucks Asia.

- Axles India manufactures drive axle housings, trailer axle beams, and hub reduction axle housings for medium and heavy-duty commercial vehicles.

Axles India Ltd Unlisted Shares IPO Details

The company has no plans to go public.

Axles India Share Price

Axle India share price is Rs 285 per share with a face value of Rs 10.

To get latest updates on Axle India Unlisted share price, Join our Whatsapp Community and Telegram Community

Axles India Valuation and Analysis

Axle India has shown fabulous growth in it’s financials in the year FY23.

Revenue has shot up by 30% in FY23 While the net profit and EPS has shot up by 57% in FY23 to Rs 745Cr and Rs52 per share respectively.

As of 14.09.2023, Price of Axle India is Rs 280 in the unlisted Market. The PE RATIO comes out to be 13.55 at this price. Comparing with it’s listed peers, such as GNA Axle , they are trading at a PE ratio of while the sector index has a average PE of which shows that axle india is available at relatively undervalued prices and has a potential good upside.

Axles India Ltd Unlisted Shares Subsidiaries

- Dana Automotive Systems Group, LLC

- Dana Commercial Vehicle Mfg. LLC

- Dana Commercial Vehicle Production, LLC

- Dana Heavy Vehicle Systems Group

- Dana Australia Pty Ltd is a company based in Australia.

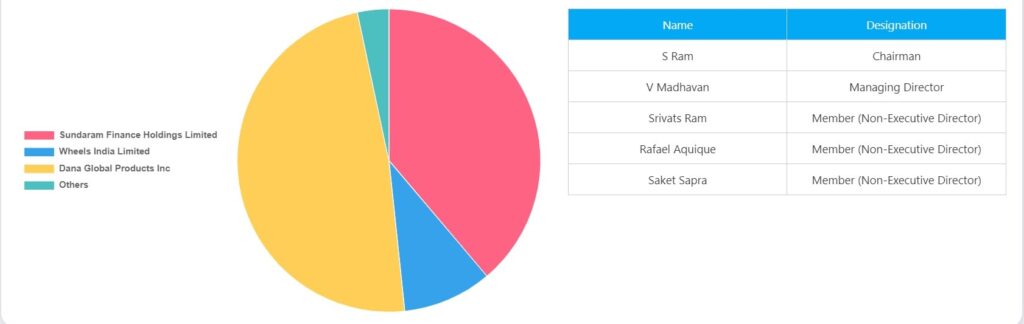

Axles India Ltd Unlisted Shares Board Members

Axles India Ltd Unlisted Shares Consolidated Results

Profit and Loss Statement

*figures in Cr. except EPS.

Balance Sheet

*figures in Cr.

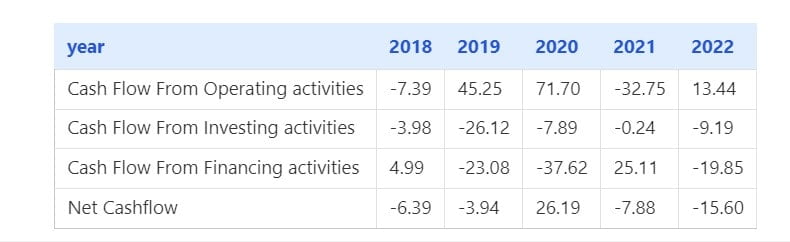

Cashflow

*figures in Cr.

News

Today in this blog, we will discuss comparison of NSE unlisted shares with its only major competitor bombay Stock Exchange. Knowing the key difference between NSE and BSE is very crucial to understand whether you should buy NSE unlisted shares or not. Here we will discuss that how is NSE different from BSE in terms of product offerings, revenue, market cap ,dividend structure ,valuation on the basis of various ratio ,management ,past performances and all the crucial factors. It is also important to discuss whether investing in NSE UNLISTED shares that is before the IPO of the company is a good option in comparison to BSE which is a listed company. NSE: NSE is one of the world’s largest exchanges and was the first exchange in India to implement electronic or screen-based trading which began its operations in 1994. NSE operates a market ecosystem to bring in transparency & efficiency. NSE’s robust state-of-the-art technology platform offers high levels of robustness, safety and resilience for trading and investment opportunities across all asset classes and for all categories of investors. The products on the Exchange are organized into 3 asset classes for trading: Capital market for the listing and trading of equities, fixed income securities and the derivatives market. Equity and equity-linked products available for trading in the cash market include stocks, IDRs, ETFs (including those benchmarked the NIFTY indices) and units of closed-ended mutual fund schemes, as well as a segment devoted to the growth of the SME’s listed on EMERGE. Under the Derivatives segment, NSE offers derivative contracts on Equity, Indices, Currency, Interest Rates and Commodities. The fixed income securities and Debt products include Negotiated Trade Reporting in Government securities, Corporate Bonds, Sovereign Gold Bonds and other debt securities traded on multiple platforms NSE is World’s Largest Derivative Exchange in terms of contracts traded. BSE: Established in 1875, BSE (formerly known as Bombay Stock Exchange), is Asia’s first & the Fastest Stock Exchange in world with the speed of 6 micro seconds and one of India’s leading exchange groups. Over the past 143 years, BSE has facilitated the growth of the Indian corporate sector by providing it an efficient capital-raising platform. Popularly known as BSE, the bourse was established as ‘The Native Share & Stock Brokers’ Association’ in 1875. In 2017 BSE become the 1st listed stock exchange of India. Let’s now have a overview on the fundamentals of both the companies: The revenue of the NSE Unlisted shares has grown mutlifolds over the past few years that is it grew from Rs 6200 Cr in FY21 to Rs 9499 Cr in FY22 to Rs 1158 Cr in FY23.’ The profit of the company also grew at the same pace i.e. from Rs 3573 Cr in FY 21 to Rs 5198 Cr in FY22 to Rs 7356 Cr in FY 23. which shows company is fundamentally strong and is making good position in the market. Valuation Comparision: As of December 2023, PE ratio of BSE is 50 while PE Ratio of NSE at price of Rs 3700 is 24 approx. Despite being having better position than BSE and monopoly position in derivatives, NSE is trading at lower PE Ratio than BSE. Ideally, NSE Unlisted shares have better potential and shall be traded at better PE Ratio than BSE. FAQ’S 1) Is it good to buy NSE Unlisted shares? It totally depends on the investor however, one should buy NSE Unlisted shares only through reliable intermediary who is expert in unlisted shares trading like Bharat Invest 2) What is NSE Unlisted Share Price today? As of 25 Decmeber 2023, NSE Unlisted Share Price is Rs 3800 Per share with a face value of Rs 1. However these price keep on changing. You can check latest price of NSE shares at bharat invest. 3) Who is owner of NSE? Various group of domestic and global financial institutions, public and privately owned entities and individuals own NSE Unlisted shares 4) How much divivdend did NSE Pay ? NSE Unlisted Shares paid a total dividend of Rs 80 per share as per latest records. Become an Angel Investor CHECK UPCOMING IPO AND INVEST BEFORE IPO Create A Free Account Now

INTRODUCTION NSE Unlisted shares have always been on point of each investor in the unlisted markets. NSE Pre-IPO Shares have been creating a lot of buzz in the unlisted markets. Nse shares seem to be blue chip stocks aimed at long term investment for every investor. Despite being a long and tedious process of NSE SHARE TRANSFER, NSE unlisted shares attract most of the investment in the markets. Let’s discusss in detail what is expected nse ipo date and what all it has to do to go for public. Thus , this blog is very crucial for every investor who has already invested in NSE PRE-IPO shares or are looking to invest in NSE Shares. NSE IPO DETAILS AND SEBI LETTER: Apart from trading, the top line was also supported by other revenue lines including listing, index services, data services, and co-location facility, the exchange said. The Securities and Exchange Board of India (SEBI) has imposed several conditions on the NSE UNLISTED SHARES for its proposed initial public offering (IPO). SEBI stated that NSE needs to be glitch free for one year straight in order to go public. SEBI wants NSE to enhance its technological infrastructure, improve the corporate governance structure and resolve pending legal matters, the report said. Previously co-allocation case against NSE delayed NSE IPO and thus now SEBI wants NSE to work seemlessly in order to provide unbiased experience to all investors over the globe. In 2021, NSE had to halt trading for several hours after its mainframe and disaster recovery sites malfunctioned, leading to intense scrutiny from SEBI. CEO of NSE Ashishkumar Chauhan had said, “Going ahead, as the number of investors in India doubles or triples from 7.5 crore currently, SEBI needs to have confidence in our processes, technology and intentions. As and when SEBI becomes more comfortable, they will tell us to apply (for IPO) and we will go ahead. Thus it is clear that NSE management wants to go public but it all depends on SEBI Final approval. Any IPO for which all private markrt investors are desperate are non other than NSE unlisted shares. It will bring huge value unlocking and potential returns to the investors. For the September quarter, NSE reported a 13 percent year-on-year growth in consolidated net profit at Rs 1,999 crore which also led to increase in investors interest in the nse unlisted shares. This has also affected NSE Unlisted share price as the demand increased in this blue-chip company. CONCLUSION Thus considering all the facts, we can come to conclusion that nse can come up with it’s IPO in an year or so and can bring potential good returns to it’s investors. But, the good point is that investors don’t need to wait for IPO to invest in NSE. They can buy NSE UNLISTED SHARES from best unlisted shares platform BharatInvest at early stage , before it’s IPO and earn mutlifolds returns. Become an Angel Investor CHECK UPCOMING IPO AND INVEST BEFORE IPO Create A Free Account Now

INTRODUCTION Studds is one of the leading helmet manufacturers in the world. With over four decades of experience, studds have become a name synonymous with excellence and have earned the trust and respect of millions. The company take pride in offering a diverse range of high-quality helmets, tailored to meet the unique needs and preferences of every rider. Studds Unlisted shares sold more than 64 Lakhs helmets in FY22-23. It exports its goods to more than 65 countries. Studds currently holds more than 25% stake in the helmet industry making a significant dent in the rider industry. The motorcycle helmet market is expected to grow at a CAGR of nearly 6.4% during 2022-30. The marginal growth is a result of subdued growth in motorcycle industry in India during the fiscal, largely due to rising inflation and resultant lower offtake of motorcycles due to higher prices. However, the government’s focus on Electric Vehicles(EVs), infrastructure development along with initiatives like FAME India, Bharatmala Pariyojana, among others are expected to contribute to the growth of two wheelers industry as a whole in the near short-term. This will augur the growth of the helmet, given the regulators’ increasing focus on road safety In FY22-23, Studds has been at the forefront of catering to demand for helmets, with our unwavering commitment to quality and innovation. STUDDS commitment to innovation, quality, comfort and customer satisfaction has helped us establish Studds as one of the leading manufacturers of helmets industry in the world. Studds with it’s high capacity and modern manufacturing facilities, we have manufactured more than 64 Lakhs of helmets and boxes during the fiscal year 2022-23. We are proud to report that this year has seen us successfully launch a range of innovative products that speak to our unwavering commitment to customer satisfaction. studds latest offerings include helmets featuring advanced safety features, stylish designs that cater to a variety of tastes, and eco-friendly materials that align with our mission to promote sustainable practices FINANCIAL PROPOSITION Against the challenging macroeconomics during the fiscal year, stuuds achieved a revenue growth of 7.93% over the previous financial year. As of FY 23, Studds reported a: 1) Total Income: Rs. 5064.80 Millions 2)Total EBITDA: 3)Rs. 674.74 Millions 4) Total PAT: Rs. 332.58 Million 5) EPS : Rs. 16.90 Detailed financial overiew of studds can be seen here: Studds IPO papers were filed in 2018 but it didn’t go public back then. The financial performace has also affected studds share price in unlisted market. You can check latest price of studds on best unlisted platform Bharatinvest. FAQ’S How do I buy Studds unlisted shares? You can buy ixigo unlisted shares using bharatinvest who is the best dealer for unlisted shares. Is studds profitable? Yes, studds is profitable. Become an Angel Investor CHECK UPCOMING IPO AND INVEST BEFORE IPO Create A Free Account Now

Ixigo is India’s leading Full-fledged online travel agent (OTA) and largest third-party train travel booking platform. Ixigo has truly show robust performance in FY23 as compared to FY22. Investors in the unlisted market have a great expectations for ixigo and it’s financial performance. Ixigo has been leading it’s industry and has a lot in bucket for future growth and expansion into various products and markets alongside with profitability. Let’s discuss about Ixigo and it’s financial performance in this blog. India is expected to move from being the 5th largest economy in 2023 to become the 3rd largestby the year 2027. With GDP growth rate of over 6%, India is expected to be the amongst thefastest growing large economy of the course of next few years. The domestic market in India issizeable, attracting foreign investors and businesses to cater to this growing demand and utilize itsworkforce potential with strong economic fundamentals. IXIGO ANNUAL REPORT 2023-2022 IXIGO OVERVIEW FY23 RESULTS OVERVIEW Ixigo has achieved a remarkable growth in it’s financials: 1) REVENUE Revenue of ixigo 32% in revenue i.e the revenue has gown up from INR 380 cr in FY22 to INR 501 Cr in FY23. This has also affected ixigo share price in the unlisted markets. Total income increased by 34.46% from ₹ 3,849.41 million in Fiscal 2022 to ₹ 5,175.73 million in Fiscal 2023 due to an increasein business activity across all the segments and growth in other income. Increased travel demanddue to travel rebound across the categories we operate in led to growth in volume of transactionson our platforms as well as improved advertising revenue. Net total revenue from contracts with customers, increased by 32.05% from ₹ 3,795.80 million inFiscal 2022 to ₹ 5,012.50 million in Fiscal 2023 and was primarily driven by (i) significant increasein ticketing revenue by 29.04% from ₹ 3,619.20 million in Fiscal 2022 to ₹ 4,670.33 million in Fiscal2023 as a result of an increase in the number of transactions on our OTA platforms, increasing ATVManagement Discussion & Analysisixigo Annual report | 17and better take rates. (ii) significant increase in advertisement revenue by 67.03% from ₹ 144.20million in Fiscal 2022 to ₹ 240.86 million in Fiscal 2023. (iii) Increase in other operating revenue dueto growth in the SaaS business. 2) EXPENSES Our expenses comprise (i) employee benefits expense, (ii) finance costs, (iii) depreciation andamortization expenses and (iv) other expenses.Total expenses increased by 20.31% from ₹ 4,025.41 million in Fiscal 2022 to ₹ 4,842.92 million inFiscal 2023, primarily due to increase in Other expenses and Employee benefits expense as well ason account of impact of full year consolidation of Abhibus, as in Fiscal 2022 Abhibus results wereconsolidated only for 8 months post completion of acquisition on August 1, 2021. 3) ASSETS Total assets increased by 8.81% from ₹ 5,384.71 million in Fiscal 2022 to ₹ 5,859.25 million in Fiscal 2023 4) Goodwill Goodwill increased by 1.71% from ₹ 2,541.37 million in Fiscal 2022 to ₹ 2,584.76 million in Fiscal 2023primarily on account of consolidation of Freshbus. As of 16.12.23 IXIGO share price is Rs 135 per share with a face value of Rs 1. To get latest updates on IXIGO share price, Join our Whatsapp Community and Telegram Community FAQ’S What is the market cap of Ixigo? Mcap of IXIGO is calculated by mutlipying per share price and number of shares. As of 16.12.23, Ixigo share price is INR 135 per share which makes it’s MCAP to be INR 5316 Cr. What is the shareholding pattern of Ixigo? Promoter holds around 17% stake in IXIGO, while other funds hold major stake in the company. How do I buy IXIGO unlisted shares? You can buy ixigo unlisted shares using bharatinvest who is the best dealer for unlisted shares. Is ixigo profitable? Yes, as per latest financials, IXIGO reported a profit of INR 51 Crore. Who is the owner of ixigo? Aloke Bajpai & Rajnish Kumar are the promoters of IXIGO Become an Angel Investor CHECK UPCOMING IPO AND INVEST BEFORE IPO Create A Free Account Now

With up to Rs 600 crore invested in product development and marketing over the next two years, domestic smartphone manufacturer Lava International anticipates a 10% market share in the sub-Rs 30,000 price range, according to a senior company official. Lava focused on its core strengths and reworked its growth strategy at a time when several Indian mobile phone companies buckled under the pressure of aggressive pricing by foreign players around 2016–17, along with difficulties presented by the implementation of the GST and demonetization.

Funded by private equity and venture money To generate money through a public offering, Capital Small Finance Bank Ltd. has submitted the draft papers to the Securities and Exchange Board of India (Sebi). The IPO consists of a fresh issue of Rs 450 crore and an offer-for-sale by the company’s current shareholders and promoters of up to 24.12 lakh shares. The Oman India Joint Investment Fund I, may hold up to 8.37 lakh shares, PI Ventures LLP may hold up to 3.37 lakh shares, Amicus Capital Private Equity | LLP may hold up to 6.05 lakh shares, Amicus Capital Partners India Fund-l may hold up to 70,178 shares, and other shareholders may hold up to 5.64 lakh shares. The issue’s main managers are Equirus Capital, DAM Capital Advisors, and Nuvama Wealth Management.

Rapido, a logistics and bike taxi aggregator, is preparing to enter the four-wheeler market, which is currently controlled by industry titans like Uber and Ola Cab. Currently, Rapido operates in the two- and three-wheeler segments with a sizable fleet that includes 7 lakh auto-rickshaws and 50 million bike taxis. Rapido thinks it’s time to enter a different market area after spending the previous eight years studying and expanding its market. “In the near future, we will introduce the four-wheeler section. Rapido thinks it’s time to enter a new market sector after investing eight years in comprehending and expanding its business. The four-wheeler category will soon be introduced by us. When we have additional details to provide, we’ll keep you informed, said Pavan Guntupalli, one of the co-founders of Rapido, to Businessline. Guntupalli stressed that there is opportunity for three to four more businesses to enter this category when talking about the competitive environment in the bike taxi industry given the demand. He added that even in the most remote areas of the nation, this expansion will ultimately result in the creation of jobs.

Axles India Ltd Unlisted Shares Documents

- Axles India Ltd Unlisted shares annual report 2018-2017

- Axles India Ltd Unlisted shares annual report 2019-2018

- Axles India Ltd Unlisted shares annual report 2020-2019

- Axles India Ltd Unlisted shares annual report 2021-2020

- Axles India Ltd Unlisted shares annual report 2022-2021

- Axles India Ltd Unlisted shares annual report 2023-2022

FAQs

Please find below the procedure for buy in Axles India Ltd Unlisted Shares/Pre-IPO shares at Bharat Invest.

- You confirm booking of Axles India Ltd Unlisted Shares/Pre-IPO shares with us at a specified price.

- You have to provide your client master report along with PAN Card and Cancelled Cheque in case you are not transferring funds from the bank account as mentioned in the CMR Copy. These are KYC documents required as per SEBI regulations.

- We will provide our bank details.

- You need to transfer funds in the current account of bharatinvest.

- No cash deposit is accepted

- Payment has to be done from the same account in which shares are to be credited.

- We ensure delivery of Axles India Ltd unlisted shares within 24 hours.

- Incase of non-availability of shares, we refund the amount to the same bank account within 24 hours.

- For detailed discussion, you can contact us via any medium.

Please find below the procedure for selling Axles India Ltd Unlisted Shares/Pre-IPO shares at Bharat Invest.

- We will confirm our buying price of Axles India Ltd Unlisted Shares/Pre-IPO shares.

- We will give you our client master report and you will transfer the Axles India Ltd Unlisted Shares/Pre-IPO shares to our demat account.

- We will transfer the funds in your bank account within 24 hours of receiving the Axles India Ltd Unlisted Shares/Pre-IPO shares.

- All the transactions will be bank to bank.

- Payment will be given in the same account which is linked to demat account or you need to provide the cancelled cheque shows your name to verify.

- You can contact us through any medium for a detailed discussion.

- The lockin period is of 6 months for pre-ipo investors i.e. they cannot sell their shares for 6 months after they get listed. However, they can definitely sell the shares in pre-ipo market before they get listed.

- With BharatInvest , you can now invest in unlisted/pre-ipo shares with as low as 25-50k depending upon the share.

- You can download the NSDL or CDSL application and login into the account and check whether the shares have been credited or not.

- Credit of Unlisted Shares/Pre-IPO shares Unlisted Shares can be checked in brokers application as well but it takes T+2 days to show the shares.

- The value of share in unlisted space is determined in the same way as it is done in listed market. Demand and supply decide the price of any share. If the demand more than the supply, then the prices of the share increases and vice versa.

- When a new shares is introduces in the unlisted space, the value of the company is decided upon the last funding raised by company. If the company hasn’t raised any funding in the past, then the valuation is decided upon the fundamentals of the company.

- All the transactions are done DEMAT to DEMAT. All the unlisted shares traded with us are available in demat accounts and are transferred to your demat within 24 hours of payment.

Bharatinvest

is India’s leading investment bank. Here you can invest unlisted, pre-ipo or

delisted shares of Axle at best price. At Bharatinvest, you will get all the

updates regarding Axle unlisted share price, IPO news, IPO price, GMP, Axle

share news, events, dividends, company related news, ISIN, lot size, Financials

( Axle Profit and loss statement, Axle Balance Sheet, Axle cash flow statement

), Peer comparision and analyst views. Investing in Axle share before ipo can

help you invest in shares when they are available at low prices. Holding them on

long term basis will help you create wealth in long term and enjoy compounding benefits.

Our investors have made an average 250% returns by investing in pre-ipo shares.

Buy Axle unlisted or Pre-ipo share at best price from our tech-platform today.

You can connect with our expert financial advisors for any guidance.