Ixigo Unlisted Shares Company Essentials

ISIN NUMBER

INE0HV901016

FACE VALUE

₹ 1

Current Ratio

1.71

EPS

₹ -0.66

P/E Ratio

N/A

NET REVENUE

₹ 384 Cr.

NET PROFIT

₹ -21 Cr.

ROE

-11.32%

Cashflow from Operations

₹ -34 Cr.

About Ixigo Unlisted Shares

- Ixigo (Le Travenues Technology Limited) is a technology company focused on empowering Indian travellers to plan, book, and manage their trips across rail, air, buses, and hotels.

- It assists travellers in making smarter travel decisions by leveraging artificial intelligence, machine learning, and data science-led innovations on its OTA platforms, which consist of websites and mobile applications.

- The company’s vision is to become the most customer-centric travel company by providing the best customer experience to travellers in the “next billion users” segment, powered by technology, cost-efficiency, and an innovative culture.

- Ixigo (Le Travenues Technology Limited) OTA platforms allow travellers to book train tickets, flight tickets, bus tickets, hotels, and cabs while providing travel utility tools and services developed using in-house proprietary algorithms and crowd-sourced information, including train PNR status and confirmation predictions, train seat availability alerts, train running status updates and delay predictions, flight status updates, bus running status, pricing and availability alerts, deal discovery, destination content, personalised recommendations, instant fare alerts for flights, and automated customer support services.

- The company’s registered users increased at a CAGR of 76.07% between Fiscal 2019 and Fiscal 2022, and the repeat transaction rate was 87.83% in Fiscal 2022. Further, the yearly downloads for the mobile apps on the Google Play Store and iOS app stores were 62.83 million, 69.61 million, 43.80 million, and 90 million in Fiscal Years 2019, 2020, 2021, and 2022, respectively, including the downloads for the ixigo, ConfirmTkt, and Abhibus apps from the date of these acquisitions.

- On train operations and ticketing across ixigo and ConfirmTkt combined, this year the company continued to remain the most used and largest train OTA in India, with a dominant and rising share of train B2C OTA bookings, where it worked in partnership with IRCTC. With the acquisition of Abhibus’ bus business, the company has strengthened its position in the next billion-user market. The company has more recently cross-integrated flights, buses, and trains across ixigo, ConfirmTkt, and Abhibus, allowing for more effective cross-selling of services across the three brands.

- Ixigo operates from Veritas Building, Sector – 53, Golf Course Road, Gurugram – 122 002, Haryana, India.

Market Statistics:

- The overall contribution of the travel and tourism industry has increased at a healthy rate of 5% from 539 trillion in 2015 to 671 trillion in 2019. India’s global rank in tourism spending is a respectable fifth, and it ranks tenth in terms of percentage of GDP spent.

- India’s tourism spending contributed 8% to the country’s GDP, which has grown at a CAGR of over 7% between 2015 and 2020. The sector witnessed significant disruption due to the COVID-19 pandemic, and according to the WTTC, the global travel industry suffered a total loss of over 320 trillion in the year 2020. The total Indian travel market has grown at an approximate CAGR of 10% from fiscal 2015, reaching $3.9 trillion in fiscal 2020. This market size is expected to grow by 7% and reach $5.01 trillion by 2024.

Key Growth Drivers of the OTA Industry:

The OTA industry across all travel segments is specifically driven by the following factors:

- The rising penetration of affordable smartphone users is expected to reach 829 million by 2022 and 1.1 billion in 2024.

- Telecommunication companies are expanding 4G services in rural areas with better connectivity and speed so that customers can use apps and easily book tickets online.

- The exponential growth of UPI and other multiple modes of digital payments has led to convenient and trusted online payments.

- Customers’ internet browsing habits demonstrate how they are accustomed to spending many hours online searching and comparing options before finally making a travel booking.

- The well-accepted value proposition of OTAs in providing information, convenience, and customer service as a one-stop shop for travel-related products is

- The ease of comparison between various travel options across carriers and modes augurs well with the price-sensitive nature of the Indian consumer, who is known to respond to even small price differentials.

- The ability of OTAs to offer competitive pricing on account of higher discounts from the OTAs themselves as well as offers from tie-ups with various banking and payment channels There has been a shift in the demographics of overall travellers to the age group of 18–35 years, which is dominating the Indian travel scene and comprising almost 66% of overall trips. This age group is much more comfortable using the internet to book and pay for services.

- ANALYSIS IF FY23-22

Ixigo Unlisted Shares IPO Details

- The company had filed the draught red herring prospectus (“DRHP”) dated August 12, 2021, with the Securities and Exchange Board of India (“SEBI”).

- The entire public offering of Ixigo (Le Travenues Technology Limited) comprises a fresh issue of equity shares of Rs. 750 crore and an offer for sale of up to Rs.850 crore in equity shares by the selling shareholders.

- Ixigo has currently delayed its IPO plans.

Ixigo Share Price

Ixigo share price is decided on the basis of it’s funding round that it raised from it’s investors. After that, price is decided by the forces of demand and supply as same as listed market. As of 16 December 2023, Ixigo share price is Rs 135 per share with a face value of Rs 1.

To get latest updates on IXIGO share price, Join our Whatsapp Community and Telegram Community

Ixigo Valuation and Analysis

Ixigo Valuation

Deal Type | Date | Amount | Raised to Date | Post-Val | Status | Stage |

14. IPO | 12-Aug-21 | $215M | 000.00 | Announced | Generating Revenue | |

13. Secondary Transaction – Private | 27-Sep-22 | 000.00 | Completed | Generating Revenue | ||

12. Secondary Transaction – Private | 07-Oct-21 | 0000 | 000.00 | 00000 | Completed | Generating Revenue |

11. Secondary Transaction – Private | 11-Aug21 | 000.00 | 000.00 | Completed | Generating Revenue | |

10. Secondary Transaction – Private | 27-Jul-21 | 0000 | 000.00 | Completed | Generating Revenue | |

9. Later Stage VC | 27-Jul-21 | 000.00 | 000.00 | 00000 | Completed | Generating Revenue |

8. Secondary Transaction – Private | 000.00 | Completed | Generating Revenue | |||

7. Later Stage VC (Series B1) | 24-Apr-20 | 00.000 | 000.00 | Completed | Generating Revenue | |

6. Later Stage VC (Series C) | 16-Nov-18 | $75M | Cancelled | Generating Revenue | ||

5. Later Stage VC (Series B) | 17-Mar-17 | $15.3M | $23.4M | 000.00 | Completed | Generating Revenue |

Ixigo unlisted shares are available at Rs. 100 with a market capitalization of 3800 Cr. in the current market scenario. The P/E ratio stands at 165x with a pat of 23 Cr which is expected to rationalize with future growth. EaseMyTrip trades at a P/E of 48x with a market cap of 3600 cr for comparison.

Ixigo Analysis

Ixigo is India’s leading hotel booking and travel management e-commerce website. Ixigo has emerged as a formidable player in the OTA sector- Online Travel Agency.

Impressive Milestones

Ixigo has surpassed the commendable milestone of 6.6 Crore monthly active users as of March 2023 across all its platforms. Ixigo is a testament to its influence in the Indian travel industry. It has 5 crore bookings annually and over 8 crore passenger segments.

Financials

Ixigo recorded an operating revenue exceeding Rs. 500 crores for the financial year 2023. ConfirTkt and AbhiBus have acquired businesses of ixigo that are helpful to make higher scale in terms of both revenue and profitability.

Market Position

Ixigo stands as the 2nd largest OTA of India by revenue for FY 22 and FY 23, according to a recent VIDEC travel industry report. The company leads the market in train booking and holds nearly a 50% market share. Ixigo is the 2nd largest OTA for bus booking.

Revenue and Expenses

In the financial year 2022, the revenue of ixigo has increased by 517 crore. The major expenses of Ixigo are- 100 Cr in Advertising, 93 Cr in promotion, and 67 Cr in Partner support costs.

Profitability and Cash EBITDA

A significant rise from last year’s 11 Cr, the Cash EBITDA for financial year 2023. Ixigo also moved from an EBITDA loss of 7 Cr in the financial year 2022.

Revenue Segmentation

Moving from 14 Cr to 24 Cr, the ticket revenue of Ixigo has increased to 467 Cr in the financial year 2023. It was much faster than the financial year 2022, where ticket revenue was 361 Cr.

Valuation and Comparison

Ixigo unlisted shares are available at only Rs. 100 in the current market scenario. There is a market capitalization of 3800 Cr and PAT of 23 Cr. The P/E ratio of Ixigo is 165x and the P/E ratio for EaseMyTrip trades is 48x with a market capitalization of 6300 Cr.

Conclusion

Ixigo has a record of demonstrating a robust financial performance. It is backed by strategic moves and a customer-centric approach. The company has implemented its plans for an IPO due to market conditions. There will be a golden opportunity for investors to invest in Ixigo because the unlisted share price of Ixigo is available in the market. Ixigo has a strong market position and a high growth trajectory. It is well-poised for success in the travel industry of India. Ixigo presents a compelling case for consideration to investors, who are looking at pre-IPO opportunities.

Ixigo Unlisted Shares Subsidiaries

- Travenues Innovations Private Limited (a wholly owned subsidiary);

- Confirm Ticket Online Solutions Private Limited (83.68% subsidiary); and

- Ixigo Europe, S.L. (a wholly owned subsidiary)

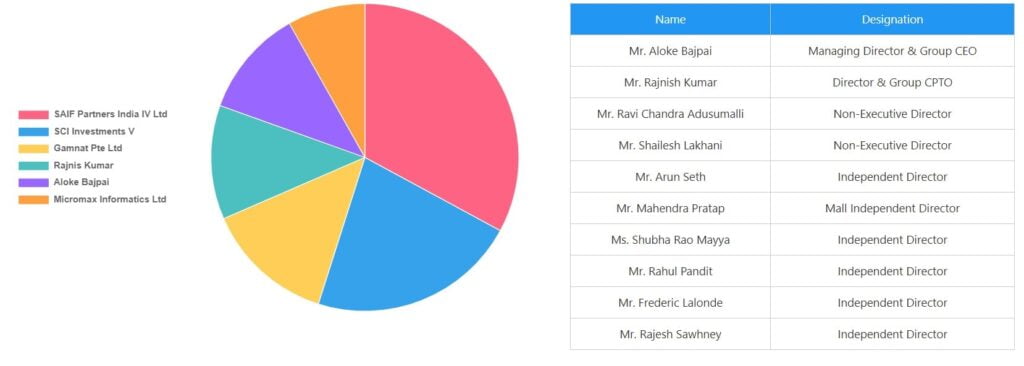

Ixigo Unlisted Shares Board Members

Ixigo Unlisted Shares Consolidated Results

Profit and Loss Statement

*figures in Cr Except EPS

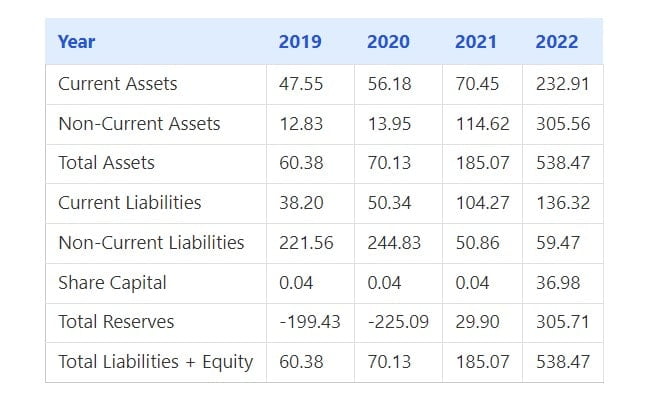

Balance Sheet

*figures in Cr

Cashflow

*figures in Cr

Ixigo Unlisted Shares News

INTRODUCTION Studds is one of the leading helmet manufacturers in the world. With over four decades of experience, studds have become a name synonymous with excellence and have earned the trust and respect of millions. The company take pride in offering a diverse range of high-quality helmets, tailored to meet the unique needs and preferences of every rider. Studds Unlisted shares sold more than 64 Lakhs helmets in FY22-23. It exports its goods to more than 65 countries. Studds currently holds more than 25% stake in the helmet industry making a significant dent in the rider industry. The motorcycle helmet market is expected to grow at a CAGR of nearly 6.4% during 2022-30. The marginal growth is a result of subdued growth in motorcycle industry in India during the fiscal, largely due to rising inflation and resultant lower offtake of motorcycles due to higher prices. However, the government’s focus on Electric Vehicles(EVs), infrastructure development along with initiatives like FAME India, Bharatmala Pariyojana, among others are expected to contribute to the growth of two wheelers industry as a whole in the near short-term. This will augur the growth of the helmet, given the regulators’ increasing focus on road safety In FY22-23, Studds has been at the forefront of catering to demand for helmets, with our unwavering commitment to quality and innovation. STUDDS commitment to innovation, quality, comfort and customer satisfaction has helped us establish Studds as one of the leading manufacturers of helmets industry in the world. Studds with it’s high capacity and modern manufacturing facilities, we have manufactured more than 64 Lakhs of helmets and boxes during the fiscal year 2022-23. We are proud to report that this year has seen us successfully launch a range of innovative products that speak to our unwavering commitment to customer satisfaction. studds latest offerings include helmets featuring advanced safety features, stylish designs that cater to a variety of tastes, and eco-friendly materials that align with our mission to promote sustainable practices FINANCIAL PROPOSITION Against the challenging macroeconomics during the fiscal year, stuuds achieved a revenue growth of 7.93% over the previous financial year. As of FY 23, Studds reported a: 1) Total Income: Rs. 5064.80 Millions 2)Total EBITDA: 3)Rs. 674.74 Millions 4) Total PAT: Rs. 332.58 Million 5) EPS : Rs. 16.90 Detailed financial overiew of studds can be seen here: Studds IPO papers were filed in 2018 but it didn’t go public back then. The financial performace has also affected studds share price in unlisted market. You can check latest price of studds on best unlisted platform Bharatinvest. FAQ’S How do I buy Studds unlisted shares? You can buy ixigo unlisted shares using bharatinvest who is the best dealer for unlisted shares. Is studds profitable? Yes, studds is profitable. Become an Angel Investor CHECK UPCOMING IPO AND INVEST BEFORE IPO Create A Free Account Now

Ixigo is India’s leading Full-fledged online travel agent (OTA) and largest third-party train travel booking platform. Ixigo has truly show robust performance in FY23 as compared to FY22. Investors in the unlisted market have a great expectations for ixigo and it’s financial performance. Ixigo has been leading it’s industry and has a lot in bucket for future growth and expansion into various products and markets alongside with profitability. Let’s discuss about Ixigo and it’s financial performance in this blog. India is expected to move from being the 5th largest economy in 2023 to become the 3rd largestby the year 2027. With GDP growth rate of over 6%, India is expected to be the amongst thefastest growing large economy of the course of next few years. The domestic market in India issizeable, attracting foreign investors and businesses to cater to this growing demand and utilize itsworkforce potential with strong economic fundamentals. IXIGO ANNUAL REPORT 2023-2022 IXIGO OVERVIEW FY23 RESULTS OVERVIEW Ixigo has achieved a remarkable growth in it’s financials: 1) REVENUE Revenue of ixigo 32% in revenue i.e the revenue has gown up from INR 380 cr in FY22 to INR 501 Cr in FY23. This has also affected ixigo share price in the unlisted markets. Total income increased by 34.46% from ₹ 3,849.41 million in Fiscal 2022 to ₹ 5,175.73 million in Fiscal 2023 due to an increasein business activity across all the segments and growth in other income. Increased travel demanddue to travel rebound across the categories we operate in led to growth in volume of transactionson our platforms as well as improved advertising revenue. Net total revenue from contracts with customers, increased by 32.05% from ₹ 3,795.80 million inFiscal 2022 to ₹ 5,012.50 million in Fiscal 2023 and was primarily driven by (i) significant increasein ticketing revenue by 29.04% from ₹ 3,619.20 million in Fiscal 2022 to ₹ 4,670.33 million in Fiscal2023 as a result of an increase in the number of transactions on our OTA platforms, increasing ATVManagement Discussion & Analysisixigo Annual report | 17and better take rates. (ii) significant increase in advertisement revenue by 67.03% from ₹ 144.20million in Fiscal 2022 to ₹ 240.86 million in Fiscal 2023. (iii) Increase in other operating revenue dueto growth in the SaaS business. 2) EXPENSES Our expenses comprise (i) employee benefits expense, (ii) finance costs, (iii) depreciation andamortization expenses and (iv) other expenses.Total expenses increased by 20.31% from ₹ 4,025.41 million in Fiscal 2022 to ₹ 4,842.92 million inFiscal 2023, primarily due to increase in Other expenses and Employee benefits expense as well ason account of impact of full year consolidation of Abhibus, as in Fiscal 2022 Abhibus results wereconsolidated only for 8 months post completion of acquisition on August 1, 2021. 3) ASSETS Total assets increased by 8.81% from ₹ 5,384.71 million in Fiscal 2022 to ₹ 5,859.25 million in Fiscal 2023 4) Goodwill Goodwill increased by 1.71% from ₹ 2,541.37 million in Fiscal 2022 to ₹ 2,584.76 million in Fiscal 2023primarily on account of consolidation of Freshbus. As of 16.12.23 IXIGO share price is Rs 135 per share with a face value of Rs 1. To get latest updates on IXIGO share price, Join our Whatsapp Community and Telegram Community FAQ’S What is the market cap of Ixigo? Mcap of IXIGO is calculated by mutlipying per share price and number of shares. As of 16.12.23, Ixigo share price is INR 135 per share which makes it’s MCAP to be INR 5316 Cr. What is the shareholding pattern of Ixigo? Promoter holds around 17% stake in IXIGO, while other funds hold major stake in the company. How do I buy IXIGO unlisted shares? You can buy ixigo unlisted shares using bharatinvest who is the best dealer for unlisted shares. Is ixigo profitable? Yes, as per latest financials, IXIGO reported a profit of INR 51 Crore. Who is the owner of ixigo? Aloke Bajpai & Rajnish Kumar are the promoters of IXIGO Become an Angel Investor CHECK UPCOMING IPO AND INVEST BEFORE IPO Create A Free Account Now

Boat, the popular wearables brand, has recently joined the Open Network for Digital Commerce (ONDC) to strengthen its presence in the Indian market. ONDC is a Government of India initiative that aims to promote the adoption of digital commerce across the country. By joining ONDC, Boat will be able to leverage its digital infrastructure and offer a seamless shopping experience to its customers. ONDC’s platform allows businesses to connect with each other and with customers in a secure and efficient manner, enabling them to tap into a wider market and increase their revenue. The move comes at a time when Boat is experiencing strong growth in the Indian wearables market. The company has been expanding its product portfolio and has recently launched a range of smartwatches and fitness trackers. With the help of ONDC, Boat is looking to further strengthen its position in the market and reach out to more customers. Boat has also been in the news recently for its unlisted shares, which have been seeing strong demand in the market. The company’s success in the wearables market has led to a surge in investor interest, with many looking to buy Boat‘s unlisted shares. As a result, the price of Boat’s unlisted shares has been steadily rising, making it an attractive investment opportunity for investors. Boat’s decision to join ONDC is a strategic move that will help the company tap into the growing Indian market and expand its reach. With its strong product portfolio and increasing demand for its unlisted shares, Boat is well-positioned to capitalize on the opportunities presented by the Indian wearables market. BoAt Share Price as of 07-05-2023 is trading at RS. 765 in the unlisted market. Get regular updates on Boat share, share price, news, corporate actions.

Ixigo Unlisted Shares FAQs

Please find below the procedure for buying Ixigo (Le Travenues Technology Limited) Unlisted Shares/Pre-IPO shares at Bharat Invest.

- You confirm booking of Ixigo (Le Travenues Technology Limited) Unlisted Shares/Pre-IPO shares with us at a specified price.

- You have to provide your client master report along with PAN Card and Cancelled Cheque in case you are not transferring funds from the bank account as mentioned in the CMR Copy. These are KYC documents required as per SEBI regulations.

- We will provide our bank details.

- You need to transfer funds in the current account of bharatinvest.

- No cash deposit is accepted

- Payment has to be done from the same account in which shares are to be credited.

- We ensure delivery of Lava unlisted shares within 24 hours.

- Incase of non-availability of shares, we refund the amount to the same bank account within 24 hours.

- For detailed discussion, you can contact us via any medium.

Please find below the procedure for selling Ixigo (Le Travenues Technology Limited) Unlisted Shares/Pre-IPO shares at Bharat Invest.

- We will confirm our buying price of Ixigo (Le Travenues Technology Limited) Unlisted Shares/Pre-IPO shares.

- We will give you our client master report and you will transfer the Ixigo (Le Travenues Technology Limited) Unlisted Shares/Pre-IPO shares to our demat account.

- We will transfer the funds in your bank account within 24 hours of receiving the Ixigo (Le Travenues Technology Limited) Unlisted Shares/Pre-IPO shares.

- All the transactions will be bank to bank.

- Payment will be given in the same account which is linked to demat account or you need to provide the cancelled cheque shows your name to verify.

- You can contact us through any medium for a detailed discussion.

- The lockin period is of 6 months for pre-ipo investors i.e. they cannot sell their shares for 6 months after they get listed. However, they can definitely sell the shares in pre-ipo market before they get listed.

- With BharatInvest , you can now invest in unlisted/pre-ipo shares with as low as 25-50k depending upon the share.

- You can download the NSDL or CDSL application and login into the account and check whether the shares have been credited or not.

- Credit of Unlisted Shares/Pre-IPO shares can be checked in brokers application as well but it takes T+2 days to show the shares.

- The value of share in unlisted space is determined in the same way as it is done in listed market. Demand and supply decide the price of any share. If the demand more than the supply, then the prices of the share increases and vice versa.

- When a new shares is introduces in the unlisted space, the value of the company is decided upon the last funding raised by company. If the company hasn’t raised any funding in the past, then the valuation is decided upon the fundamentals of the company.

- All the transactions are done DEMAT to DEMAT. All the unlisted shares traded with us are available in demat accounts and are transferred to your demat within 24 hours of payment.

The minimum ticket size for investment has reduced over the years as more and more people have started investing in the unlisted market. Currently, the minimum ticket size for LE Travelnews Technology Limited is between 30K to 50K.

Once the lock-in period ends, investors should not redeem their investments immediately. They should review the performance of the investment and then decide whether to redeem or not. In the case of ELSS mutual funds, investors should review the performance of their funds.

Buying and selling unlisted shares of Ixigo in India is undoubtedly 100% legal. Yes, it is 100% legal and safe to buy and sell unlisted shares of Ixigo in India. To buy unlisted shares of Le Travenews Technology Limited (Ixigo). However, the same is applicable when you buy unlisted shares of Le Travenews Technology Limited (Ixigo) from trusted and known unlisted share dealers. You can request a quotation or trade online on Stockify, we are ready to assist you.

They are also the third largest flight OTA in India with a market share of 12% in online air booking in FY 2021 (Source: F&S Report).

Rs 1,600 crore through public offering. According to DRHP, the offer includes Rs. Rs 850 crore as OFS (offer for sale) and Rs. Rs 750 crore as a fresh issue of equity shares.

What is the equity structure of ixigo as per the latest cap tables? Funds hold the majority of ixigo shares, at 55.88%, while Founders hold 17.64%, Enterprise holds 15.90%, Others hold 4.64%, ESOPs hold 4.46% and Angels hold 0.02%.

Rajneesh launched ixigo.com in India in 2007 and under his leadership, ixigo ranked among the top 10 downloaded travel apps worldwide and was also the 8th fastest-growing OTA app in 2022, according to Data.

Ixigo.com’s closest competitor is RailYatri.in, IndiaRailInfo.com and Confirmt.com. To understand more about ixigo.com and its competitors, sign up for a free account to explore SEMrush’s traffic analytics and market explorer tools.

Ixigo.com’s nearest competitors are RailYatri.in, IndiaRailInfo.com and Confirmt.com. To understand more about ixigo.com and its competitors, sign up for a free account to explore SEMrush’s traffic analytics and market explorer tools.

The startup reported a net loss of Rs 21.1 crore in FY2012, compared to a profit of Rs 7.5 crore in FY2011. Ixigo’s operating revenue grew 32% to Rs 501.2 crore in 2013 from Rs 379.6 crore in the previous fiscal. As a travel aggregator, ixigo earns the majority of its revenue from the sale of various travel and related services.

Ixigo is a travel and hotel booking platform based in India. It allows users to search and compare flights, hotels, and travel packages from various online travel agencies and booking websites. Additionally, ixigo provides travel-related information such as flight status, fare alerts, and travel tips. It aims to simplify the travel planning process for its users.

Bharatinvest is India’s leading investment bank. Here you can invest unlisted, pre-ipo or delisted shares of Ixigo (Le Travenues Technology Limited) at best price. At Bharatinvest, you will get all the updates regarding Ixigo (Le Travenues Technology Limited) unlisted share price, IPO news, IPO price, GMP, Ixigo (Le Travenues Technology Limited) share news, events, dividends, company related news, ISIN, lot size, Financials ( Ixigo (Le Travenues Technology Limited) Profit and loss statement, Ixigo (Le Travenues Technology Limited) Balance Sheet, Ixigo (Le Travenues Technology Limited) cash flow statement ), Peer comparision and analyst views. Investing in Ixigo (Le Travenues Technology Limited) share before ipo can help you invest in shares when they are available at low prices. Holding them on long term basis will help you create wealth in long term and enjoy compounding benefits. Our investors have made an average 250% returns by investing in pre-ipo shares. Buy Ixigo (Le Travenues Technology Limited) unlisted or Pre-ipo share at best price from our tech-platform today. You can connect with our expert financial advisors for any guidance.