Bira Unlisted shares Company Details

ISIN NUMBER

INE833U01014

FACE VALUE

₹ 10

Current Ratio

0.72

EPS

₹ -81.07

P/E Ratio

N/A

NET REVENUE

₹ 733.76 Cr

NET PROFIT

₹ -335.07 Cr.

ROE

-393.05%

Cash flow from Operations

₹ -179.73 Cr.

About Bira Unlisted shares

- Bira 91 is a craft beer brand manufactured by B9 Beverages, launched in 2015. The company’s first brewery unit was in the Flanders region of Belgium, where a craft distillery was used to contract manufacture the beer with ingredients from France, Belgium, the Himalayas, and Bavarian farms, and the beer was imported to India. After initial success, the company thereafter began manufacturing the beer in India with the same ingredients, and they now have 5 breweries in India. Bira 91 beers are now available in over 600 towns and cities spread across 18 countries.

- The company derives revenue from the manufacture and sale of beer under the name BIRA91. The company provides light beer, white ale, strong ale, blonde lager, IPA, and Boom strong and classic beers. Bira 91 also offers branded merchandise across categories such as glassware, apparel, and gifts to make every day a lot more playful.

- Bira 91 is driven by a dynamic team of over 600 passionate beer lovers and is backed by Sequoia Capital India, Sofina of Belgium, and Kirin Holding of Japan.

- In Q1 FY23, 11 pints of beer were consumed per second.

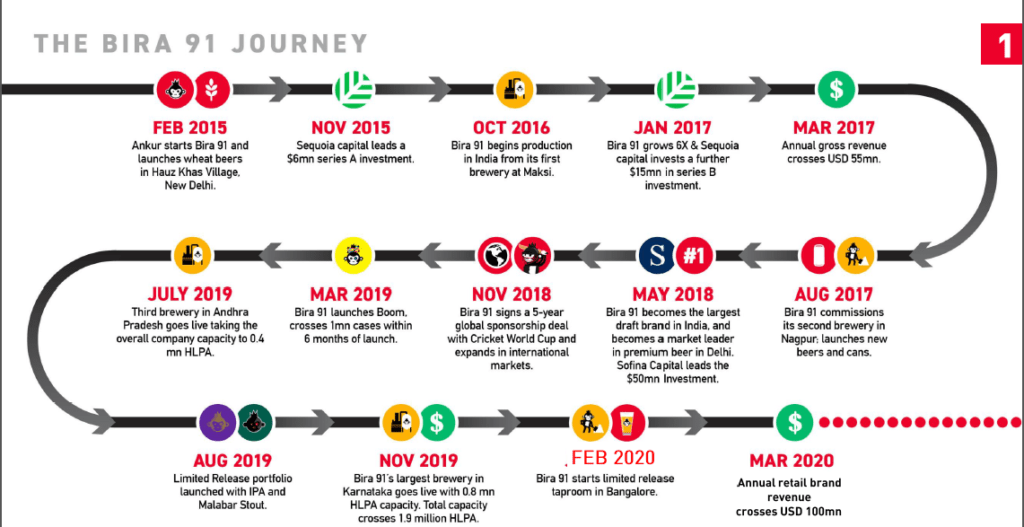

- Bira91’s journey can be seen through this:

- Here are some facts about bira :

Bira Unlisted shares IPO Details

Bira has no plans to go public as of now.

Bira Share Price

Bira share price is decided on the basis of it’s funding round that it raised from it’s investors. After that, price is decided by the forces of demand and supply as same as listed market. Bira share price is Rs 600 per share with a face value of Rs 10.

To get latest updates on Bira share price, Join our Whatsapp Community and Telegram Community

Bira Valuation and Analysis

Latest Funding News: Bira 91 Bags $10 Mn Funding from japan MUFG Bank Japan’s MUFG Bank

In this round the company has raised funds at Rs 718/- per equity share. Previously, the company has raised millions of dollars from Kirin Holdings, Seqouia and any others.

Bira 91 has shown impressive growth in it’s revenue which grew almost 2x in the year FY22. The company is currently loss making because it’s burning cash to fuel it’s growth.

Bira Unlisted shares Subsidiaries

- Pomelo Flavormaker Merchandise and Event Pvt Ltd.

- B9 Beverages PTE LTD; Singapore;

- B9 Beverages SPRL; Belgium,

- B9 Beverages INC; USA

Bira Unlisted shares Board Members

Bira Unlisted shares Consolidated Results

Profit and Loss Statement

*figures in Cr. except EPS

Balance Sheet

*figures in Cr.

Cashflow

*figures in Cr.

Bira Unlisted shares News

Some of the unlisted shares are always in highlight and always attracts investors interest. The reason behind the same is that these companies are consumer facing and investors are themselves their consumers and thus they are able to align their interest with the company. Let’s discuss about such company that is Bira 91 unlisted shares today in detail: Bira 91 Beer is manufacturer of crafted premium beer and is making it’s way to disrupt the beer industry. There main products include different types of beer that GenZ consumes. Recently, the company has moved beyond beer and started producing Ale and has also launched taprooms that attract a lot of audience and works as a good marketing technique for the company. Bira 91 is backed by a lot of big investors such as kirin holdings and has utilised the funds to grow their costumers base, products lines and manufacturing facilities. Bira 91 has closed their last round of funding at 718 per equity share. Strong institutional investors interest in the company shows that the Bira91 has good future outlook. Let’s take a look on the Bira 91 equity share details as of 15.09.2023 ISIN INE833U01014 SHARE PRICE RS 650 per equity share FACE VALUE RS 10 per equity share INDUSTRY BEER Manufacturing To get latest updates on Bira share price, Join our Whatsapp Community and Telegram Community Investors usually have a doubt have can buy Bira 91 unlisted shares when the company is private and how are they able to get shares at such undervalued rates? Well to answer this, Bharatinvest unique platform helps investors buy Bira91 unlisted shares . They get access to more than 250+ unlisted shares any time and can invest in highly undervalued shares before their IPO and gain wealth appreciation. FAQ’s You can check on bharatinvest’s high tech platform rates of bira share price ion daily basis. 2) How will i get to know about the latest news of bira91 share? You can check daily news regarding bira ipo, bira funding and everything on our portal 3) How is bira share price affected in the unlisted markets? Demand an supply affect the bira share price in the unlisted markets

Bira 91, the leading Indian craft beer brand, has announced its latest offering to coincide with the ongoing Indian Premier League (IPL) season. The company has launched limited-edition beers and merchandise inspired by two popular IPL teams – Mumbai Indians and Delhi Capitals. This move highlights Bira 91‘s commitment to providing customers with innovative and exciting experiences. The limited-edition beers come in stylish cans with the team logos and colors, providing fans with a unique way to support their favorite teams. The merchandise, on the other hand, includes T-shirts, caps, and other accessories that showcase the team spirit of the Mumbai Indians and Delhi Capitals. The collaboration with two IPL teams is a significant milestone for Bira 91, reflecting the brand’s growing presence in the Indian market. With the IPL being one of the most-watched sports leagues in the world, this partnership is expected to generate a lot of interest among cricket fans and beer enthusiasts alike. According to Ankur Jain, the founder and CEO of Bira 91, the collaboration with Mumbai Indians and Delhi Capitals is an exciting opportunity to connect with fans and create a unique brand experience. Jain further stated that Bira 91 is committed to bringing new and innovative ideas to its customers, and the limited-edition beers and merchandise are an excellent example of this commitment. The launch of the limited-edition beers and merchandise also comes at a time when the demand for craft beer is on the rise in India. Bira 91 has been at the forefront of this trend, with its innovative flavors and unique branding. The company’s continued focus on creating new and exciting experiences for its customers is expected to further boost its popularity in the Indian market. Conclusion Bira 91’s collaboration with Mumbai Indians and Delhi Capitals is an exciting development for cricket and beer enthusiasts in India. The limited-edition beers and merchandise offer a unique way for fans to show their support for their favorite IPL teams while enjoying the distinctive flavors of Bira 91’s craft beer. This move also highlights the company’s commitment to innovation and customer experience, which is expected to fuel its growth in the Indian market. BIRA 91 share price as of 27/04/2023 is Rs 720. Get regular updates on BIRA91 share Price , unlisted shares only on Bharat Invest.

Bira Share Price as of 22-02-2023 is trading at RS. 765 in the unlisted market. You can connect with bharatinvest to invest in Bira share. Get regular updates on Bira share, share price, news, corporate actions. Indian craft beer brand Bira 91 has forayed into the Hard Seltzers category with the launch of ‘Grizly’ Hard Seltzer Ale. The launch comes shortly after the introduction of ‘Hill Station’ Hard Cider Ale and is part of the brand’s ambition to move beyond beers to cater to the evolving preferences of young consumers. With the lines between different types of beverages also blurring, Bira 91’s ‘Grizly’ Hard Seltzer Ale brings consumers the best of bespoke cocktails, wine, and beer – in one single can. Offering an all-natural, low-sugar option that is tailor made for mindful consumers, this blend is crafted by master mixologists, who have taken inspiration from classic cocktails to deliver an unparalleled drinking experience, the company further said. Bira91 says Grizly Hard Seltzer Ales are all-natural, low sugar, drinks that infuse finest herbs and fruits that nature has an offer with alcohol. Available in three flavours-Pineapple & Okinawa, Peach & Black Tea, and Blueberry & Rosemary, these seltzers have been masterfully twisted by expert mixologists and are highly sessionable REPORT: BIRA UNLISTED SHARE SOURCE: BUSINESSLINE

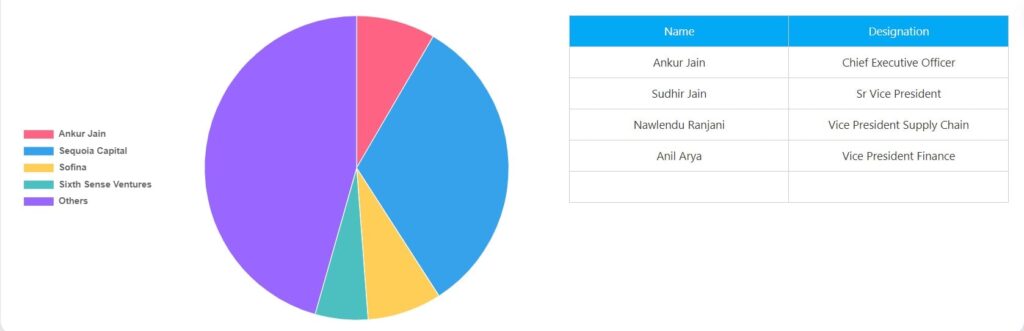

Shareholders of Bira (B9 Beverages Pvt Ltd)

SHAREHOLDERS OF BIRA | EQUITY |

Ankur Jain | 24.4 |

Day1 Advisors Private Limited | 16.3 |

Shashi Jain | 11.2 |

Sci Investments V | 8.4 |

Sequoia Capital India Inv. IV | 4.5 |

Sixth-Sense India Opportunities – II | 2.8 |

Lti Jain | 1.9 |

Shantanu Rastogi | 1.9 |

Anshul Agarwal | 1.8 |

Bira Unlisted Share Price Overview

In recent years, Bira, which is well-known for its handmade craft beverages, has been gaining popularity. Unlike listed companies, its share price has not been made public yet as it is an unlisted business. Experts’ and investors’ private transactions or appraisals can still be used to provide an estimate of the worth of Bira’s shares. The huge market demand for craft beer, Bira’s financial performance, its expansion goals, and investor sentiment toward the beverage sector are all the major factors affecting the company’s share price. Investors who are interested in Bira can inquire with private equity firms, investment banks, or other private market sources for information, even though the exact share price may not be easily available to the public. In addition, Bira’s stock price could change in response to a number of internal and external factors that impact the business and the industry as a whole.

Why Buy Bira Unlisted Shares?

- Purchasing or investing in unlisted shares of Bira has a number of advantages. The first advantage is that Bira is a well-known brand in the craft beer industry, distinguished by its distinct flavors. Investors can own a portion of this well-known brand and can possibly make money as the business expands by purchasing its shares.

- Secondly, compared to other well-established, publicly listed companies, Bira could possibly have greater potential for growth. As it is an unlisted business, the market is still increasing. It also means that if Bira continues to increase its market share and earnings, investors may experience higher returns on their investments ( ROI ).

- Moreover, investors may expand their investments by purchasing unlisted shares of Bira. Investors can reduce overall investment risk by spreading their risk across multiple industries by holding shares of beverage companies.

- All things considered, buying unlisted shares in Bira can be a great method for investors to expand their investments, help a well-known brand expand, and possibly even earn higher profits.

Bira Unlisted shares Documents

- Bira Unlisted shares annual report 2018-2019

- Bira Unlisted shares annual report 2019-2020

- Bira Unlisted shares annual report 2021-2022

FAQs

Please find below the procedure for buying Bira Unlisted Shares/Pre-IPO shares at Bharat Invest.

- You confirm booking of Bira Unlisted Shares/Pre-IPO shares with us at a specified price.

- You have to provide your client master report along with PAN Card and Cancelled Cheque in case you are not transferring funds from the bank account as mentioned in the CMR Copy. These are KYC documents required as per SEBI regulations.

- We will provide our bank details.

- You need to transfer funds in the current account of bharatinvest.

- No cash deposit is accepted

- Payment has to be done from the same account in which shares are to be credited.

- We ensure delivery of Bira unlisted shares within 24 hours.

- Incase of non-availability of shares, we refund the amount to the same bank account within 24 hours.

- For detailed discussion, you can contact us via any medium.

Please find below the procedure for selling Bira Unlisted Shares/Pre-IPO shares at Bharat Invest.

- We will confirm our buying price of Bira Unlisted Shares/Pre-IPO shares.

- We will give you our client master report and you will transfer the Bira Unlisted Shares/Pre-IPO shares to our demat account.

- We will transfer the funds in your bank account within 24 hours of receiving the Bira Unlisted Shares/Pre-IPO shares.

- All the transactions will be bank to bank.

- Payment will be given in the same account which is linked to demat account or you need to provide the cancelled cheque shows your name to verify.

- You can contact us through any medium for a detailed discussion.

The lockin period is of 6 months for pre-ipo investors i.e. they cannot sell their shares for 6 months after they get listed. However, they can definitely sell the shares in pre-ipo market before they get listed.

With BharatInvest , you can now invest in unlisted/pre-ipo shares with as low as 25-50k depending upon the share.

- You can download the NSDL or CDSL application and login into the account and check whether the shares have been credited or not.

- Credit of Unlisted Shares/Pre-IPO shares can be checked in brokers application as well but it takes T+2 days to show the shares.

- The value of share in unlisted space is determined in the same way as it is done in listed market. Demand and supply decide the price of any share. If the demand more than the supply, then the prices of the share increases and vice versa.

- When a new shares is introduces in the unlisted space, the value of the company is decided upon the last funding raised by company. If the company hasn’t raised any funding in the past, then the valuation is decided upon the fundamentals of the company.

All the transactions are done DEMAT to DEMAT. All the unlisted shares traded with us are available in demat accounts and are transferred to your demat within 24 hours of payment.

Bharatinvest

is India’s leading investment bank. Here you can invest unlisted, pre-ipo or

delisted shares of Bira91 at best price. At Bharatinvest, you will get all the

updates regarding Bira91 unlisted share price, IPO news, IPO price, GMP, Bira91

share news, events, dividends, company related news, ISIN, lot size, Financials

( Bira91 Profit and loss statement, Bira91 Balance Sheet, Bira91 cash flow

statement ), Peer comparision and analyst views. Investing in Bira91 share

before ipo can help you invest in shares when they are available at low prices.

Holding them on long term basis will help you create wealth in long term and

enjoy compounding benefits. Our investors have made an average 250% returns by

investing in pre-ipo shares. Buy Bira91 unlisted or Pre-ipo share at best price

from our tech-platform today. You can connect with our expert financial

advisors for any guidance.