Mohan Meakin Unlisted Shares Company Details

ISIN NUMBER

INE136D01018

FACE VALUE

₹ 5

Current Ratio

2.09

EPS

₹ 60.47

P/E Ratio

26.71

NET REVENUE

₹ 1379 Cr.

NET PROFIT

₹ 51 Cr.

ROE

27.85%

Cashflow from Operations

₹ 47.68 Cr.

About Mohan Meakin Unlisted Shares

Mohan Meakin Limited (“the Company”) is a public limited company incorporated and domiciled in India with its registered office at Solan Brewery in Himachal Pradesh. It was formerly known as E. Dyer & Co., Dyer Meakin & Co. Ltd., Dyer Meakin Breweries Ltd., and Mohan Meakin Breweries Ltd. and was established as far back as 1855.

The company is manufacturing beer of all types and IMFS brands, including premium rums, whiskies, brandies, vodkas, and gins (ready to drink in 3 flavors). In addition to its two main products, beer and IMFS, the company also manufactures juices, canned products, cornflakes, wheat porridge, and vinegars.

At present, the company has the following manufacturing centers, besides other breweries and distilleries established under collaboration arrangements in various other places in India. Solan Brewery (H.P.) Beer manufacturing and bottling plant for IMFL bottling. Kasauli Distillery (H.P.) Malt spirit distillery. Mohan Nagar (Ghaziabad) (U.P.): brewery, distillery, breakfast foods factory, fruit products factory Mohangram Bhankarpur (Punjab) Bottling Plant for bottling of IMFL. Lucknow (U.P.) Distillery—Production has stopped for the time being.

- The company’s products are quite popular in the market and are well received by the customers because they are quality products. The company has introduced a premium brand of single malt whisky known as Solan Gold Indian Single Malt Whisky in H.P. and is introducing it in other states of the country. The product has been well received on the market. The company is in the process of increasing its production not only for H.P. and Chandigarh but also for other states and exports to other countries.

- The company’s products include Old Monk Rum Very Old Vatted XXX Rum, Old Monk White Rum, Old Monk Legend Rum, Old Monk Deluxe Very Old Vatted XXX Rum, Old Monk Supreme Rum, Old Monk Apple Rum, Old Monk Orange Rum, Old Monk Gold Reserve Rum, The Solan Gold Indian Single Malt Whisky, Old Monk 10000 Super Strong Beer, and Old Monk the Original Premium Beer 650 ML Bottles are exported to 16 countries, i.e., the U.A.E., Qatar, Russia, Singapore, Malaysia, Germany, New Zealand, Canada, the UK, Australia, Estonia, the USA, Ukraine, Zambia, Oman, and Japan.

- The company’s revenue streams are from 3 areas of activities:

a) Manufacture and Sale of Alcoholic Products and Matured Spirits

b) the manufacture and sale of non-alcoholic products, and

c) Royalty and technical know-how by allowing bottling and manufacturing of the company’s products throughout India.

Mohan Meakin Unlisted Shares IPO Details

-

The shares of the company are listed on the Calcutta Stock Exchange, but no trading takes place there. The shares of Mohan Meikin are heavily traded in the unlisted market.

- Mohan Meikin (old monk) share price is Rs. 1550-1600 in the unlisted market

Mohan Meakin Share Price

Mohan Meakin share price is decided on the basis of it’s funding round that it raised from it’s investors. After that, price is decided by the forces of demand and supply as same as listed market. Mohan Meakin share price is Rs 1550 per share with a face value of Rs 5.

Mohan Meakin Peers

Following are the close Listed Peers of the company:

Mohan Meakin Valuation and Analysis

Mohan Meakin Unlisted Shares Subsidiaries

-

There is no subsidiary and/or associate company of Mohan Meakin Limited.

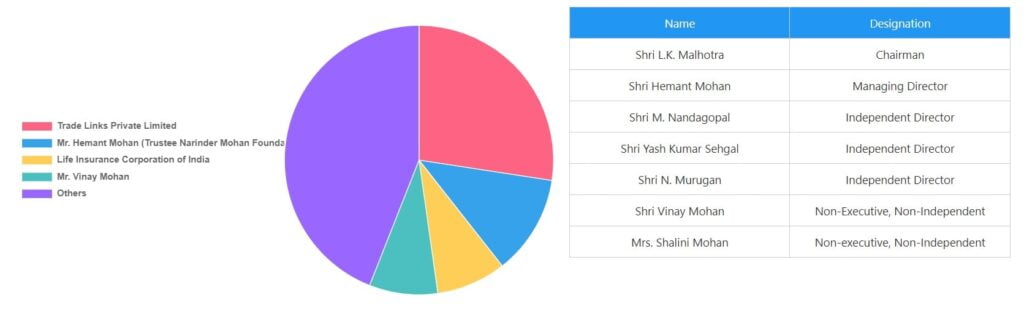

Mohan Meakin Unlisted Shares Board Members

Mohan Meakin Unlisted Shares Consolidated Results

Profit and Loss Statement

*figures in Cr Except EPS

Balance Sheet

*figures in Cr

Cashflow

*figures in Cr

Mohan Meakin Unlisted Shares News

Lets Analyze Orbis Financial for FY22-23 Results. How it affects Orbis Share Price? Introduction Established in 2005, Orbis Financial Corporation Limited is an established Financial Services Company committed towards Investor servicing in inter-related verticals namely Custody & Fund Accounting services, Equity and Commodity derivatives clearing, Currency derivatives clearing, Registrar and Transfer Agency and Trustee services. Orbis client base includes varied category of institutional and retail investors including FPI, FDI, Mutual Funds, Endowments & Trusts, High Networth Individuals, AIFs, Stock Brokers, Private Bankers and Portfolio Managers. The Company is headquartered in Gurugram, Haryana, while the Marketing Office is situated in Mumbai KEY HIGHLIGHTS of FY23: Asset Under Custody: AUC increased from Rs 67,369 Cr in FY22 to Rs 81,160 Cr in FY23. PAT increased from Rs 47 Cr in FY22 to Rs 89.57 Cr in FY23 EPS increased from Rs 5.41 in FY22 to Rs 8.94 in FY23. Total Net worth of the company increased from Rs 223 Cr to Rs 429 Cr in FY23. Orbis aims to clock a revenue of Rs 500 Cr in FY24 and PAT of Rs 100 Cr in FY 24. At this growth, it may provide good returns to the investors. During FY22-23, orbis: Crossed 2,700 mark of onboarded custody clients with Assets under Custody increasing to INR 81,160 crores as on March 31, 2023 Average volume across cash and derivative markets increases to INR 13,000 crores on daily basis Currently the PE Ratio of Orbis is 13 at a share price of Rs 125. Upcoming expectations of results and growth projections may affect orbis share price and may make it move in the upward direction. However, do your own due diligence before investing in Orbis Unlisted Shares. You buy Orbis Financial Unlisted Shares using Bharatinvest’s Portal and check daily Orbis Share Price.

Orbis Financial Share Price as of 22-02-2023 is trading at RS. 87 in the unlisted market. You can connect with bharatinvest to invest in Orbis Financial’s share. Get regular updates on Orbis share, share price, news, corporate actions Ace investor Ashish Kacholia has participated in a funding round by Orbis Financial Corporation that also saw the participation of other marquee investors, both existing and new. The company has raised Rs 111 crore augmented by stellar growth in assets under custody (AUC), clearing services, trustee, RTA, fund accounting, etc REPORT: ORBIS FINANCIAL UNLISTED SHARE Source: Economic Times

Mohan Meakin Unlisted Shares FAQs

Please find below the procedure for buying Mohan Meakin Ltd. Unlisted Shares/Pre-IPO shares at Bharat Invest.

- You confirm booking of Mohan Meakin Ltd. Unlisted Shares/Pre-IPO shares with us at a specified price.

- You have to provide your client master report along with PAN Card and Cancelled Cheque in case you are not transferring funds from the bank account as mentioned in the CMR Copy. These are KYC documents required as per SEBI regulations.

- We will provide our bank details.

- You need to transfer funds in the current account of bharatinvest.

- No cash deposit is accepted

- Payment has to be done from the same account in which shares are to be credited.

- We ensure delivery of Mohan Meakin Ltd. unlisted shares within 24 hours.

- Incase of non-availability of shares, we refund the amount to the same bank account within 24 hours.

- For detailed discussion, you can contact us via any medium.

Please find below the procedure for selling Mohan Meakin Ltd. Unlisted Shares/Pre-IPO shares at Bharat Invest.

- We will confirm our buying price of Mohan Meakin Ltd. Unlisted Shares/Pre-IPO shares.

- We will give you our client master report and you will transfer the Mohan Meakin Ltd. Unlisted Shares/Pre-IPO shares to our demat account.

- We will transfer the funds in your bank account within 24 hours of receiving the Lava Unlisted Shares/Pre-IPO shares .

- All the transactions will be bank to bank.

- Payment will be given in the same account which is linked to demat account or you need to provide the cancelled cheque shows your name to verify.

- You can contact us through any medium for a detailed discussion.

- The lockin period is of 6 months for pre-ipo investors i.e. they cannot sell their shares for 6 months after they get listed. However, they can definitely sell the shares in pre-ipo market before they get listed.

- With BharatInvest , you can now invest in unlisted/pre-ipo shares with as low as 25-50k depending upon the share.

- You can download the NSDL or CDSL application and login into the account and check whether the shares have been credited or not.

- Credit of Unlisted Shares/Pre-IPO shares Unlisted Shares can be checked in brokers application as well but it takes T+2 days to show the shares.

- The value of share in unlisted space is determined in the same way as it is done in listed market. Demand and supply decide the price of any share. If the demand more than the supply, then the prices of the share increases and vice versa.

- When a new shares is introduces in the unlisted space, the value of the company is decided upon the last funding raised by company. If the company hasn’t raised any funding in the past, then the valuation is decided upon the fundamentals of the company.

- All the transactions are done DEMAT to DEMAT. All the unlisted shares traded with us are available in demat accounts and are transferred to your demat within 24 hours of payment.

Bharatinvest is India’s leading investment bank. Here you can invest unlisted, pre-ipo or delisted shares of MOHAN MEIKIN at best price. At Bharatinvest, you will get all the updates regarding MOHAN MEIKIN unlisted share price, IPO news, IPO price, GMP, MOHAN MEIKIN share news, events, dividends, company related news, ISIN, lot size, Financials ( MOHAN MEIKIN Profit and loss statement, MOHAN MEIKIN Balance Sheet, MOHAN MEIKIN cash flow statement ), Peer comparision and analyst views. Investing in MOHAN MEIKIN share before ipo can help you invest in shares when they are available at low prices. Holding them on long term basis will help you create wealth in long term and enjoy compounding benefits. Our investors have made an average 250% returns by investing in pre-ipo shares. Buy MOHAN MEIKIN unlisted or Pre-ipo share at best price from our tech-platform today. You can connect with our expert financial advisors for any guidance.